Issues with Multiple Utility Services in KYC

2015/01/20

Arin Ray

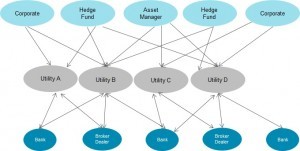

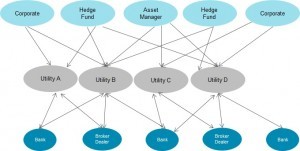

In a recent blog post we discussed about the emergence of utility model in the KYC, on-boarding space in the capital market. When one thinks of a utility model in KYC, one envisions a situation where a single utility will cater to the needs of the whole industry. That would be the optimal arrangement for a utility service, not just in KYC, but for any functions.  However, currently the situation looks a little different from what one would ideally want. We already have 3-4 utilities – from SWIFT, Thomson Reuters, Markit | Genpact, and DTCC and cofounding banks – catering to same, or overlapping areas within the KYC space. While SWIFT has positioned itself for the correspondent banking segment, the other three utilities are very similar in terms of their coverage.

However, currently the situation looks a little different from what one would ideally want. We already have 3-4 utilities – from SWIFT, Thomson Reuters, Markit | Genpact, and DTCC and cofounding banks – catering to same, or overlapping areas within the KYC space. While SWIFT has positioned itself for the correspondent banking segment, the other three utilities are very similar in terms of their coverage.  The multiple utilities therefore give rise to some redundancies and duplications that ironically they intend to eliminate, which makes the situation sub optimal from an overall industry perspective. This raises a few questions regarding the future of the KYC utilities.

The multiple utilities therefore give rise to some redundancies and duplications that ironically they intend to eliminate, which makes the situation sub optimal from an overall industry perspective. This raises a few questions regarding the future of the KYC utilities.

However, currently the situation looks a little different from what one would ideally want. We already have 3-4 utilities – from SWIFT, Thomson Reuters, Markit | Genpact, and DTCC and cofounding banks – catering to same, or overlapping areas within the KYC space. While SWIFT has positioned itself for the correspondent banking segment, the other three utilities are very similar in terms of their coverage.

However, currently the situation looks a little different from what one would ideally want. We already have 3-4 utilities – from SWIFT, Thomson Reuters, Markit | Genpact, and DTCC and cofounding banks – catering to same, or overlapping areas within the KYC space. While SWIFT has positioned itself for the correspondent banking segment, the other three utilities are very similar in terms of their coverage.  The multiple utilities therefore give rise to some redundancies and duplications that ironically they intend to eliminate, which makes the situation sub optimal from an overall industry perspective. This raises a few questions regarding the future of the KYC utilities.

The multiple utilities therefore give rise to some redundancies and duplications that ironically they intend to eliminate, which makes the situation sub optimal from an overall industry perspective. This raises a few questions regarding the future of the KYC utilities. - Why have multiple utilities for the same function?

- Or Can FIs satisfy their needs by subscribing to a single utility, or do they need to subscribe to many or all of them? We have seen several banks have taken active role in developing more than one utility, so this is a possibility. But is it desirable for every fo every bank to have to do so?

- Another question that is still waiting for a clear answer is in terms of geographic or jurisdictional coverage of these utilities. Will these utilities be mainly global in nature containing information on, and serving institutions in the developed global markets? Or will they also include coverage of local firms? Would they be able to sufficiently cater to regulatory and business requirement of each local market, or will their appeal be mostly restricted to the main developed markets?