WESTPAC UNITE PROGRAM:簡素化によるエバーグリーン・プラットフォームの実現

One of Australia’s top four banks, Westpac, recently provided an investor update on its UNITE program. The core focus of this program is simplification, with the bank looking to eliminate duplicated platforms and rationalize processes.

In turn, this is a part of a wider enterprise technology roadmap to move the bank on a set of modern ‘evergreen’ platforms that are highly automated and fully digital but also built to change and are supported with persistent teams. Like evergreen trees, these are maintained as continually up-to-date platforms, rather than the traditional ‘deciduous’ seasonal model of build, with lengthy sweating of assets, before costly upgrades down the line.

Simplification can enable significant business benefits for both customers and staff

The central rationale here is that common platforms make it easier both for customers to deal with the bank, and for the bank’s employees to serve their customers. For instance, Westpac is seeking to reducing the number of banker platforms down from 6 to 3 (one platform each for sales and service, customer management, and for teller systems). Similarly, it is planning to reduce the number of customer onboarding systems from 11 to 1. In both cases, this reduces staff training, increases staff productivity (reducing analog to digital processes), and provides a more consistent (and more automated) customer experience, while also allowing greater security visibility and control, and process speed.

While this will have direct immediate business benefits, importantly it also provides lower ongoing run and change costs. The bank no longer needs to maintain multiple platforms providing the same functionality, and development focus is confined to a single platform. Here, for example, Westpac believes that the cost of implementing open banking in Australia (based on the Consumer Data Right legislation) was 30% higher than it should have been for the bank given the need to implement it across multiple applications.

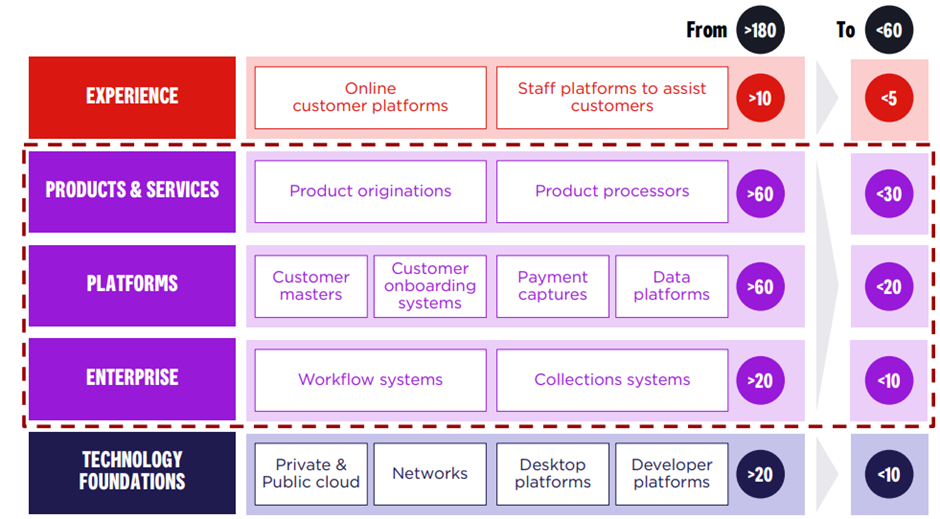

In total, with its UNITE program Westpac is planning to reduce around 180 discrete systems and processes down to around 60 across different technology layers. Interestingly this is not necessarily moving to a common platform across all systems - it still plans to maintain different cores between Westpac and St George customers (in the medium term at least) – rather it has prioritized areas that drive customer or employee experiences, having modularized a lot of key processes outside of the core already that would drive this.

Source: Westpac Banking Corporation

With this, the bank believes that the UNITE program will be a major driver for it to close its cost income ratio gap compared to its peers (ANZ, CBA and NAB), enabling it to get both ‘run’ cost efficiency benefits, and reduce the cost of future change.

However, simplification requires a technology and data foundation as well as development capacity

Now given these benefits, simplification can sound like a rather obvious strategy. In fact, a key question addressed was: ‘why now?’ While this is partly akin to the Chinese proverb: “The best time to plant a tree was 20 years ago. The second best time is now.”, technology simplification needs to take place within a framework of business simplification and transformation combined with a target operating model vision. Technology platforms are inherently intertwined with business processes and business structures that is very challenging to change one without impacting the other. It also requires an infrastructure and data foundation, and creation of an engineering capability (and capacity) to deliver both consolidation and modernization, as well as ongoing development of target state platforms.

Here Westpac has recently been through the process of portfolio simplification, exiting 10 businesses to focus on four key segments (consumer, business and wealth, and institutional (WIB), plus New Zealand), as well as business simplification - reducing number of products offered by 37% in last 3 years. It has also invested in heavily in its technology foundations, consolidating its number of networks down from 9 to 1 (a software-defined wide area network with double the bandwidth at half the cost), centralizing its data platforms to single platform in the cloud (using Azure), and reducing its data centers from 4 to 2. Alongside this it has developed a software engineering platform to provide both a common development approach and create capacity.

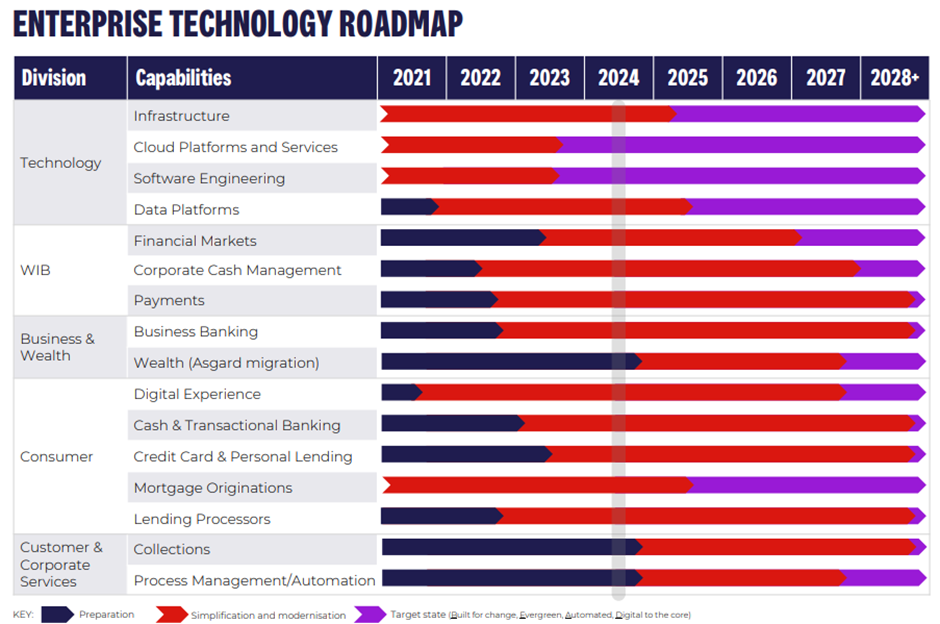

Having done much of the technology foundation, it is now looking to simplify and modernize its main business-led capabilities in domain specific areas across WIB, business and wealth, and consumer. The UNITE program will be delivered through a program of around 85 initiatives that are sequenced fairly linearly over 2024 to 2028 to manage the risk of the program (instead of having one big monolithic platform or build). For each, the key stages include preparation, simplification and modernization, and managing the target state platform. While the program is coordinated centrally for efficiency and control, it will be delivered by teams with most subject matter expertise, in close conjunction with roadmap business owners, and direct business ownership and accountability.

Here key initiatives for 2024 include consolidation of 22 retail electronic identity verification processes to 1, as well as consolidating customer information masters from 3 platforms to one, making this API-enabled to provide a common capability for all Australian customers.

Source: Westpac Group March 2024 Technology Simplification Update

It also requires significant investment

In addition to development of foundation capability, technology simplification requires significant investment. Westpac expects total investment spend to run at AU$1.8bn (US$1.2bn) in 2024, with average annual spend running at around AU$2bn (circa US$1.3bn) p.a. over 2025 to 2028. While this includes spend on growth and productivity as well as its regulatory and risk projects, the UNITE program will represent around 30% of overall spend over the total period (around AU$3bn or US$2bn) with most of this expensed rather than capitalized. This because in most cases Westpac is looking to consolidate onto existing platforms rather than develop new capabilities, although it is looking at fourth generation product processors where this makes sense (such as 10X Banking for institutional banking).

While this is a significant investment (annualized investment representing around 6% of 2023 total operating expenses), Westpac expects this to ultimately reduce both technology and business run costs as well as enterprise change costs, being the major driver in its goal of reducing its cost income ratio gap against peers by 2029.

Simplification should be a key part of bank transformation strategies

From a Celent perspective, it is refreshing to see both the scale and commitment to technology simplification from Westpac. Most banks, particularly those who have grown through acquisition, operate with multiple, fragmented, and duplicated technology platforms and business processes. While strategies such as offshoring and cloud migration can provide short-term alleviation, the ability to move to a sustainable long-term target state architecture that enables ongoing innovation at a low cost requires modernization. And for most, while a significant investment, simplification will be a key enabler to manage both the cost and risks of this transition.