信用の拡大:信用市場におけるホールセールバンクの役割の進化

A Report from Oliver Wyman and Morgan Stanley

Morgan Stanley and OliverWyman just published their annual “bluepaper” for global banks and asset managers. This year’s theme is “Extending Credit: The Evolving Role of Wholesale Banks in Credit Markets." The discussion focuses on how the traditional bank credit model has evolved, with an increasing number of non-bank players in Liquid and Private Credit.

The Global Financial Crisis drove wholesale banks to reshape their business models across most segments, building resilience and generating sustainable returns. But credit is one segment that hasn’t changed as rapidly. We still see credit as a core driver of bank relationships, with relationship managers originating, underwriting, and managing a portfolio of loans for their bank’s commercial and corporate clients. According to Oliver Wyman, credit products contribute ~$440 BN in revenue for banks globally, equally split across Corporate and Institutional Banking (CIB) and the Commercial Bank.

However, with banks facing more significant capital and regulatory pressures, many banks have reduced their lending appetite. The resulting lack of supply resulted in substantial growth for the private credit market. Private credit refers to non-bank lending provided to companies or individuals by private investors or institutions rather than through traditional public markets or banks. Private credit managers continue to expand their reach into product areas traditionally dominated by banks, such as asset-based financing and infrastructure finance.

While OW and MS sees $35-50 BN of the $440 BN credit revenue pool at risk for banks, there is also a significant opportunity for growth. Private Credit managers may emerge as major clients for banks that provide asset origination, asset servicing, fund- and asset level financing, etc. For banks who have or can adapt their models to serve these clients, there is a projected $15 BN in incremental revenue growth.

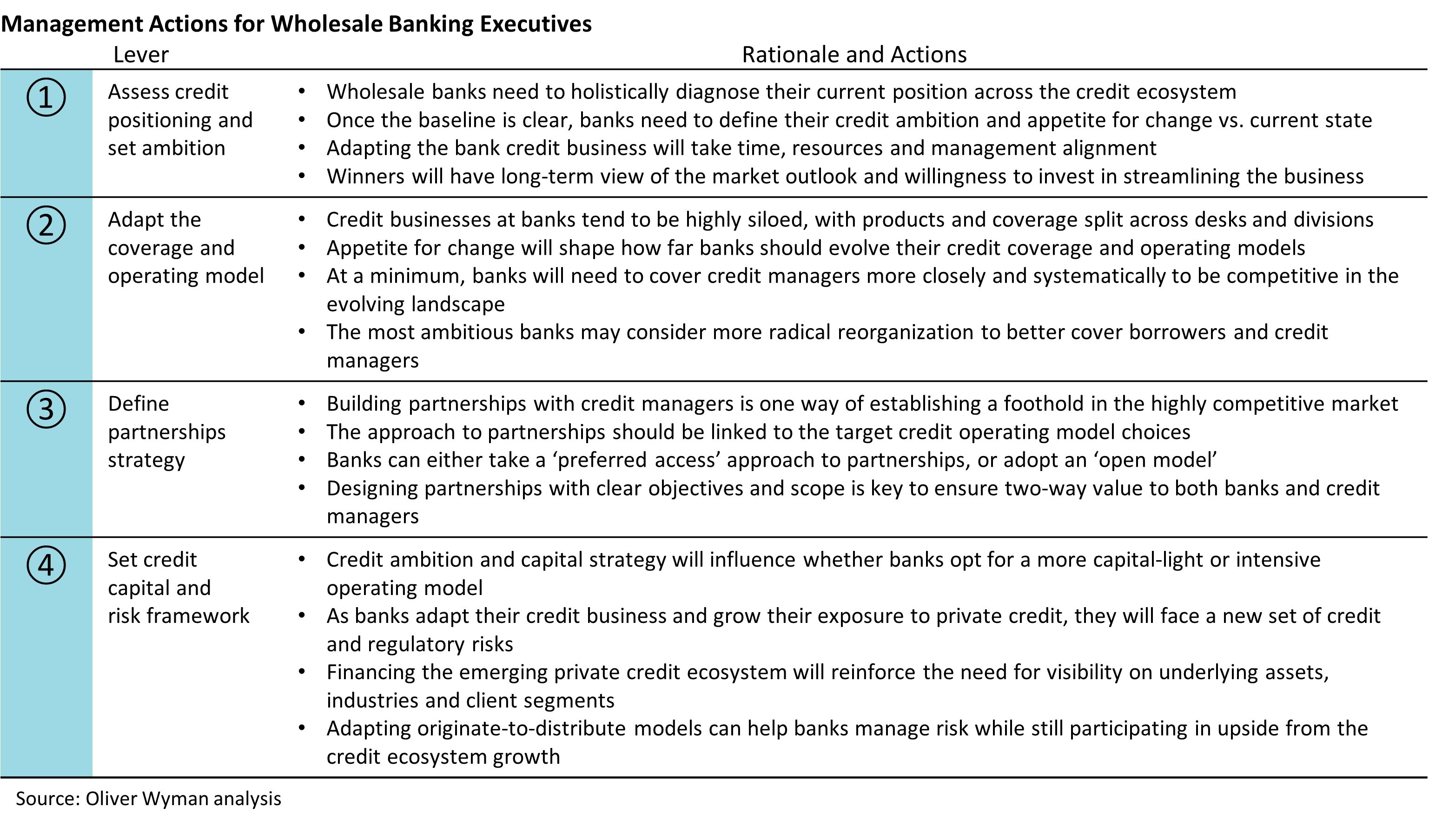

For banks to protect and grow the economics of their credit business, the authors detail four levers for management action:

You can read the full report on OliverWyman.com: The Evolving Role of Wholesale Banks in Credit Markets