Risk and Compliance Research Outlook 2025

Adjusting to a New Environment: Our 2025 Risk and Compliance Research Themes

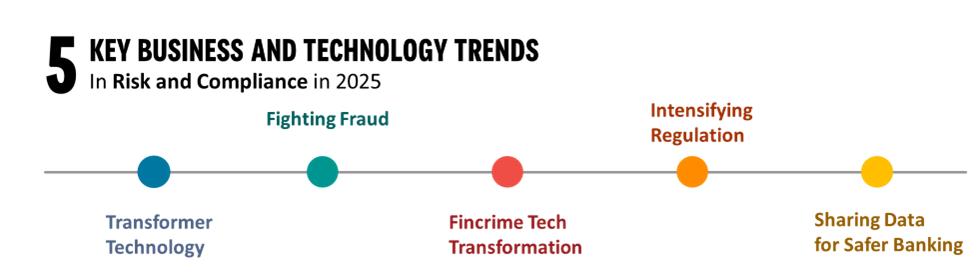

As we approach 2025, Risk and Compliance executives across financial services are facing fast changing geopolitical risks, a surge in sophisticated fraud schemes, intensifying regulatory demands, and an increasingly complex landscape of financial products (including digital assets). Rapid advancements in AI and other technologies offer more powerful capabilities and more cost-efficient approaches to navigating these challenges but must be harnessed in a compliant, secure, and governable way.

Below you will see the five technology trends we see having an impact on our clients’ risk management and regulatory compliance in 2025. How the geopolitical, regulatory, and competitive environment will change under a new US President is just beginning to take shape. So, just as markets and businesses are adjusting to the prospect of the incoming Trump administration, so is our research agenda. We expect material changes in policies for AI, sanctions, and crypto, to name a few and this is reflected in our research for the upcoming year.

- FIs need to maintain the brisk pace of innovation in AI as the prospect of inhibiting regulation recedes. We see Transformer Technology as the next leap forward in generative AI, and it is one of the main themes in our 2025 Risk Previsory webinar.

- Banks are already investing to become more nimble, in response to geopolitical risks, and we recommend continued investment in enterprise risk technology. To help with that, we are publishing a vendor landscape of ERM technology providers in the first quarter.

- The market is also expecting that crypto and digital assets will benefit from the new administration. Luckily, we have a new report on crypto-investigative tools coming out in early January.

- There are also sure to be material changes to sanctions, and technical transformation in financial crime compliance is another major theme of this year’s Risk Previsory.

In Q1, we will have the next iteration of our annual Dimensions report - our annual survey of 200+ Risk Executives on their technology priorities, investment plans, and leading technology projects for the coming 18 months. In Q2, we will release deep dives on this data for different geographies (NA, Europe, AP), and industries (banking, insurance). It will also serve as a key input for our estimates of IT and Operational Spending report which will come out in Q3.

In Q2, we will also announce the winners of our Model Risk Manager Awards to recognize financial institutions for best practices of technology usage in all aspects of risk and compliance and publish detailed case studies of these initiatives.

In these challenging times, one thing is certain: none of us can go it alone. As you face hard decisions in the areas of technology and partnerships, Celent is here to support you. We can help you vet partners and technologies as you respond to competitive and government initiatives, the changing needs of your customers, and growing cost pressures.

We’ll look to be nimble and respond to fast-moving developments in our research space. So, if you have a hot topic in mind where our research could add value to your organization, please get in touch, and we’ll endeavour to incorporate it into our research agenda.

Contact us for more information about what we have planned in Q1 2025.

If you are a client, please sign in to access a detailed view of our 2025 agenda.