Property Casualty Insurance Research Outlook 2025

Leveraging Transformative Efficiency: Our 2025 Research Themes

The chaos of the pandemic era led to major strategic changes for P&C insurance in the past couple years. Supply chain shocks that impacted replacement and repair costs across lines of business, while devastating catastrophe events led to high reinsurance costs. Insurers responded with retrenchment, raising rates as much as markets would bear and pulling out of those that could not be profitable. However, that trend is not sustainable. Insurance cannot survive in a smaller addressable market.

So, in 2024, insurers returned to prioritizing growth. But the path to growth has a different feel these days. While the innovations of the years leading up to the pandemic were focused on customer acquisition at all costs, the cost pressures of the 2020s find insurers focusing on driving efficiency in the business processes that underpin all segments of the value chain. Transformation is not just about putting a fancy digital front-end on insurance products. While customer-facing platforms are still evolving at a high level, more attention is being paid to what’s behind the scenes.

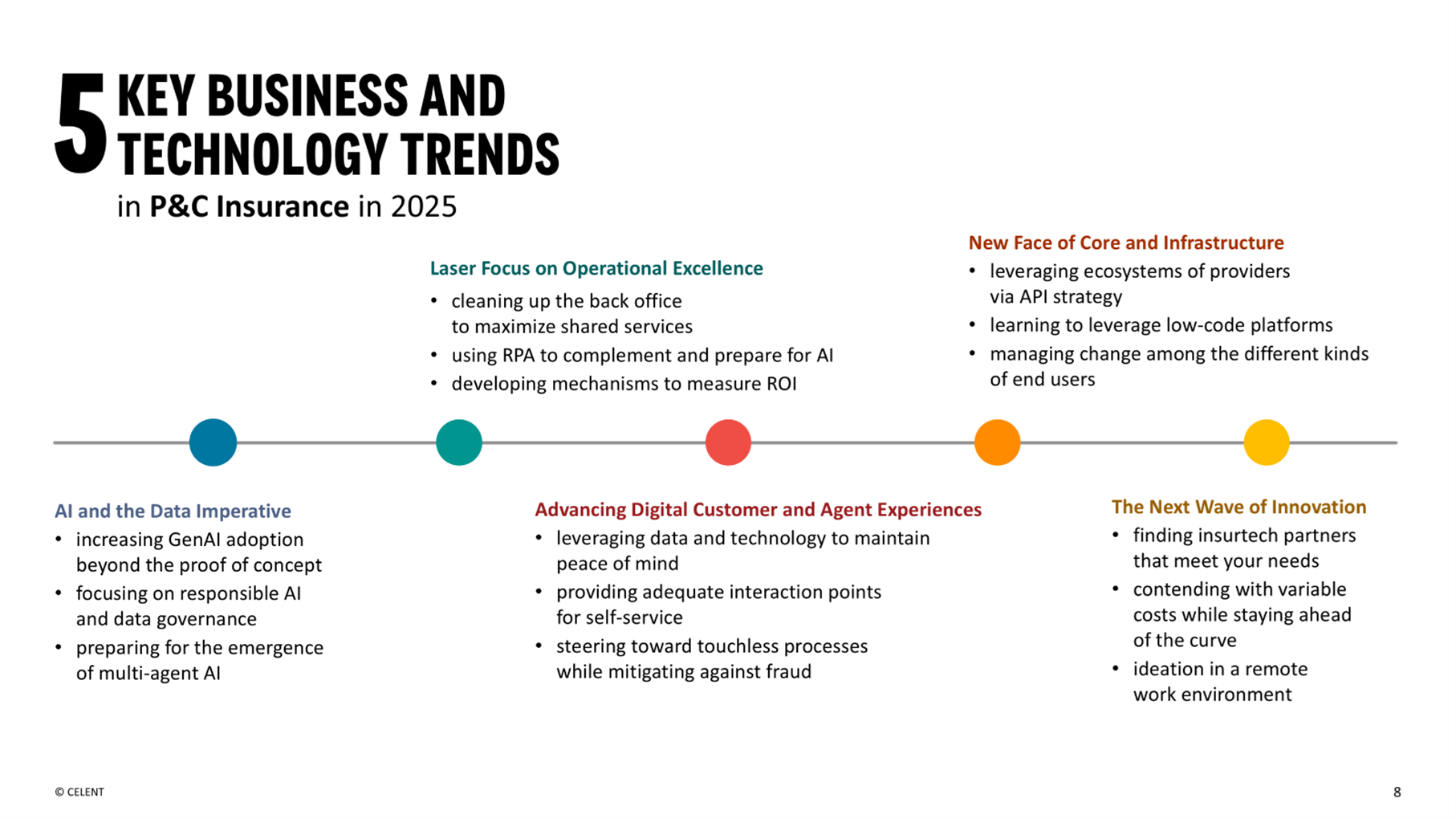

In 2025, insurers will focus on transformative efficiency -- leveraging artificial intelligence (including the rapidly ascending generative AI/large language model (LLM) space) as well as other forms of automation and straight-through processing to reduce the time spent on each discrete task within the enterprise. Celent sees five key trends powering this shift:

These five themes, which appeared in our 2025 Previsory, will guide our research agenda in the coming year. We expect 2025 to be a transformative year in insurance, buoyed by a clarity of purpose around efficiency and growth and with lessons in technology strategy, partnerships, and market dynamics from the past several years of chaos absorbed.

The challenge for insurers is that to meet growth objectives by leveraging digitalization, they also must make major investments in data management and governance. Insurers are also contending with a changing workforce, with experienced workers across functional areas leaving the industry via retirement. Not only do they need to be replaced, but their years of experience must be passed down to a new generation – creating another barrier to efficient operations.

In 2025, Celent research will dive into the many options insurers have to use technology to mitigate the risks associated with these challenges. We welcome our clients’ input into helping us shape these conversations and stand ready to develop this thought leadership into actionable insight for you. That includes helping vet partners and solutions, develop strategic plans and everything in between. There’s a lot of headroom for innovation in insurance this year – let’s explore it together.

Contact us for more information about what we have planned in Q1 2025.

If you are a client, please sign in to access a detailed view of our 2025 agenda.