Wealth Management Research Outlook 2025

Integrating NextGen Tech and the Human Touch to Create the Holistic Wealth Management Partner

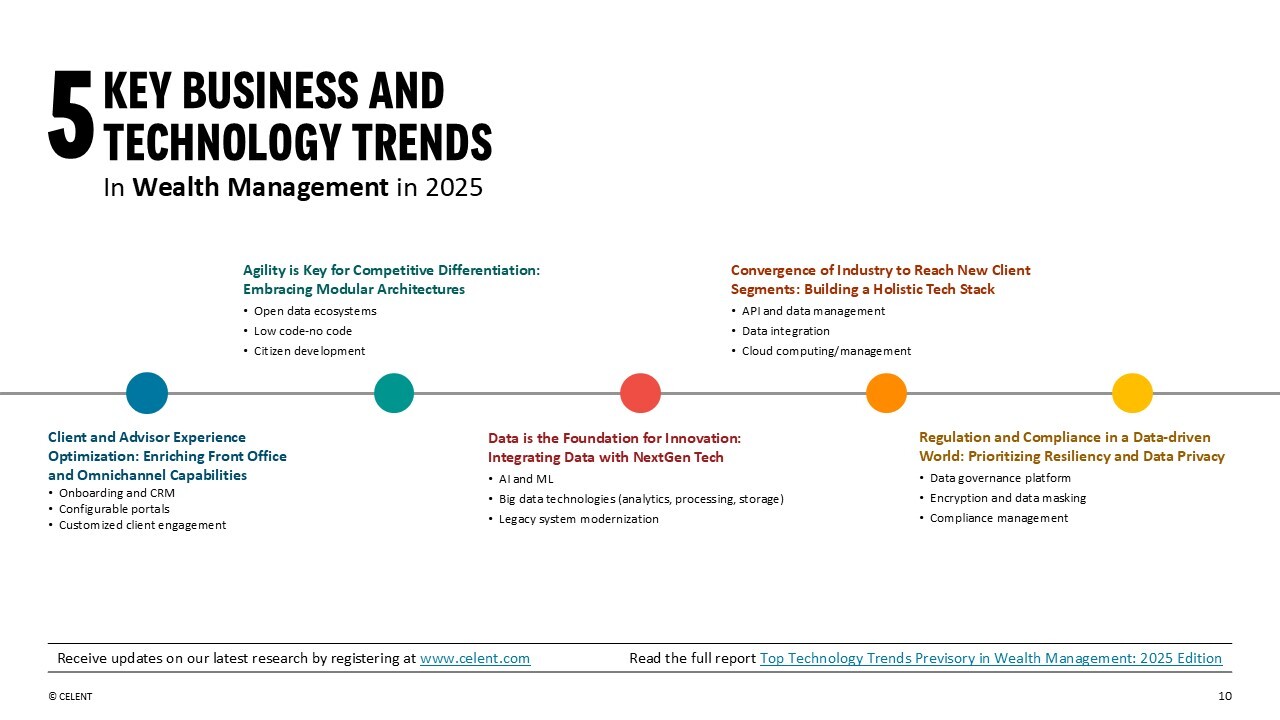

Our Top Technology Trends Previsory in Wealth Management in 2025 highlights the shift from a period of relative tech stagnation to a future defined by accelerated integration and innovation. This evolution will blend NextGen technology, open ecosystems, and the essential “human touch,” fundamentally redefining the roles of industry players.

A significant factor driving this change is the shift in the core client base – through the intergenerational wealth transfer and the retiring population, which will increase the demand for personalized and holistic wealth management solutions. This presents a unique opportunity for firms to leverage advanced technologies and data analytics to better understand and meet the distinct needs and preferences of their clients.

In this competitive landscape, wealth managers should adopt a deliberate approach to embracing NextGen technologies. These tools can enhance data management, streamline processes, and deliver personalized experiences to an expanding client base. A key area of differentiation will be breaking down data silos to create a holistic tech stack that anticipates client needs.

Notably, AI is moving fast – the transition from AI assistants to AI agents represents a seismic shift at the core of the new wealth management paradigm, enabling actions that reimagine and optimize workflows.

GenAI is emerging as a trusted source of advice, expressing confidence in AI for significant life decisions, such as purchasing a home or using AI over human advisors for financial guidance. This shift highlights the potential of GenAI to meet traditionally human needs, as consumers are more likely to seek connection and a sense of purpose in their finances through AI. As AI evolves from assistants to agents, it will enable personalized experiences at scale, integrating corporate values and compliance into its framework. While the role of human advisors will change, they will remain essential in the wealth management landscape, requiring firms to adapt to the growing comfort of investors with GenAI and AI agents.

Separately, we welcome you to participate in our 2025 Model Wealth Manager Awards program, the submissions window for which is currently open, and closes on January 17th, 2025.

Contact us for more information about what we have planned in Q1 2025.

If you are a client, please sign in to access a detailed view of our 2025 agenda.