Corporate Banking Research Outlook 2025

Introducing Our 2025 Research Themes

2025 will be another year of change and opportunity for corporate banking. Technology budgets are expected to increase by 6% on average, as institutions look to push ahead in unlocking efficiency improvements across their estates, while also delivering enhanced products and experiences to customers.

Building the foundations for next-generation banking is a growing priority, and the degree to which banks are successful at delivering simplification, modernisation, and resilience will influence the shape of the future competitive landscape. Indeed, the impact of making the right (or wrong) technology choices has never been greater. Public cloud, modern data platforms, cybersecurity, and AI in all forms remain some of the highest priority technology investment areas for the industry, and this will continue in 2025.

These changes will be delivered in what remains a challenging operating environment. A return to relative economic stability is welcome but will bring a further squeeze on margins as interest rates continue to fall. In addition, there remains considerable potential for further political instability, which may reduce consumer and business activity. Banks must also balance their growth plans against the need to meet a growing compliance burden. New requirements covering resilience, security, payments, data, and AI are all coming down the pipe and will consume resources.

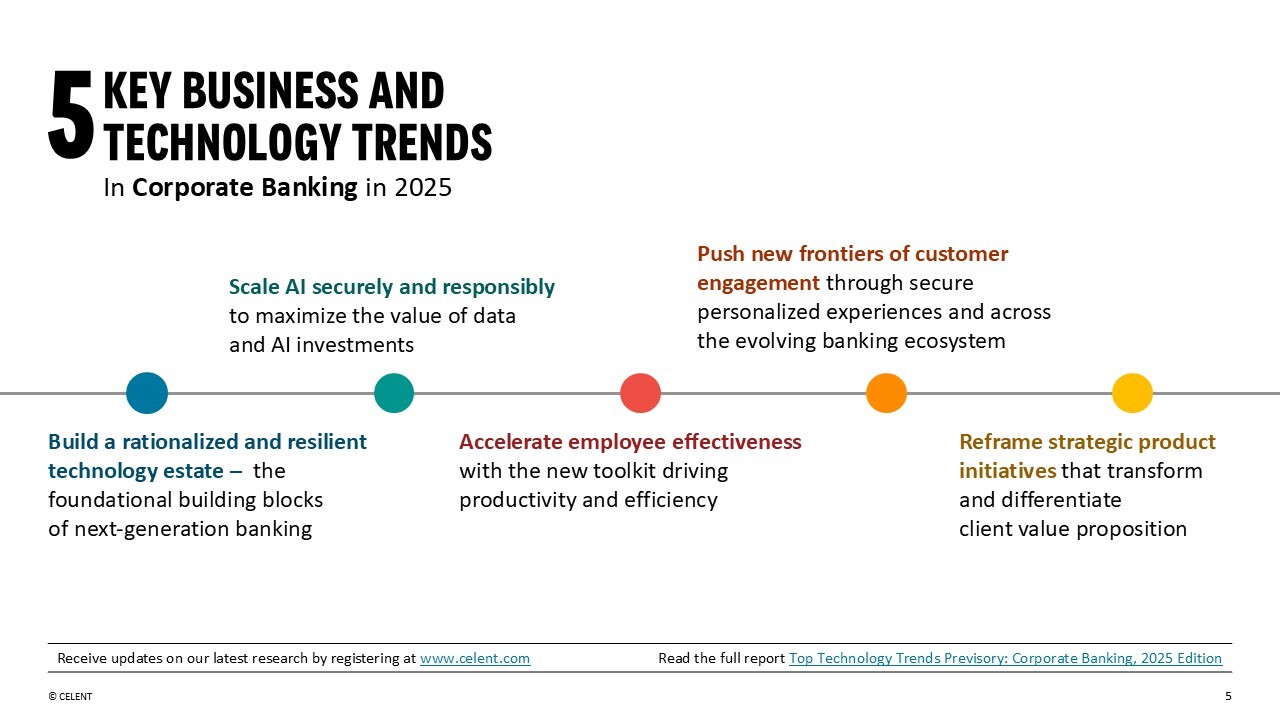

In the most recent edition of its flagship Previsory report, Celent has identified five technology-related trends that will dominate the Banking industry in 2025:

These trends also inform and guide our research agenda for 2025. While we’ll look to be nimble and respond to fast-moving developments in the industry, we intend to focus our research efforts around four major research projects:

- Building a Rationalized, Resilient, Intelligent, and Efficient Bank – guidance and insights on how to deliver next-generation banking, scale AI, and accelerate employee effectiveness, bringing in examples of those who do it well.

- Engagement Banking in an Open Ecosystem – best practices and solution options for customer engagement, decisioning, and personalization; making the most out of open banking and embedded finance opportunities.

- Transforming the Payments Landscape – key industry developments driving the need for transformation in payments, innovative propositions, and solution options, with special focus on Europe and the US.

- Reframing Strategic Product Initiatives – the interplay of trade finance, cross-border payments, and foreign exchange; transforming and differentiating transaction banking/ cash management client propositions.

And of course, we’ll continue our flagship annual programs, such as Dimensions surveys offering insights into the ever-evolving bank technology investment priorities (Q1), Model Bank award-winning case studies, published slightly later this year in June (Q2), and Previsories, our take on top technology trends (Q4).

Contact us for more information about what we have planned in Q1 2025.

If you are a client, please sign in to access a detailed view of our 2025 agenda.