Life Insurance Research Outlook 2025

Leveraging Transformative Efficiency to Drive Growth: Our 2025 Research Agenda

Since the pandemic, the issue of public health has rarely been more salient. COVID-19 itself impacted life expectancy, and co-morbidities elevated chronic disease to a kitchen-table discussion. This would seem to be a boon for life and health insurers, who could capitalize on the acute feeling of risk felt among consumers to sell more products to help mitigate it.

But the path to growth has a different feel these days. While the innovations of the years leading up to the pandemic were focused around customer acquisition at all costs, the cost pressures of the 2020s find insurers focusing on driving efficiency in the business processes that underpin all segments of the value chain. After all, affordability of these lines of insurance continues to be a major barrier to sales. Insurers must find ways to lower the costs of their products and grow their addressable audience while maintaining underwriting discipline, especially as consumers are facing rising costs everywhere.

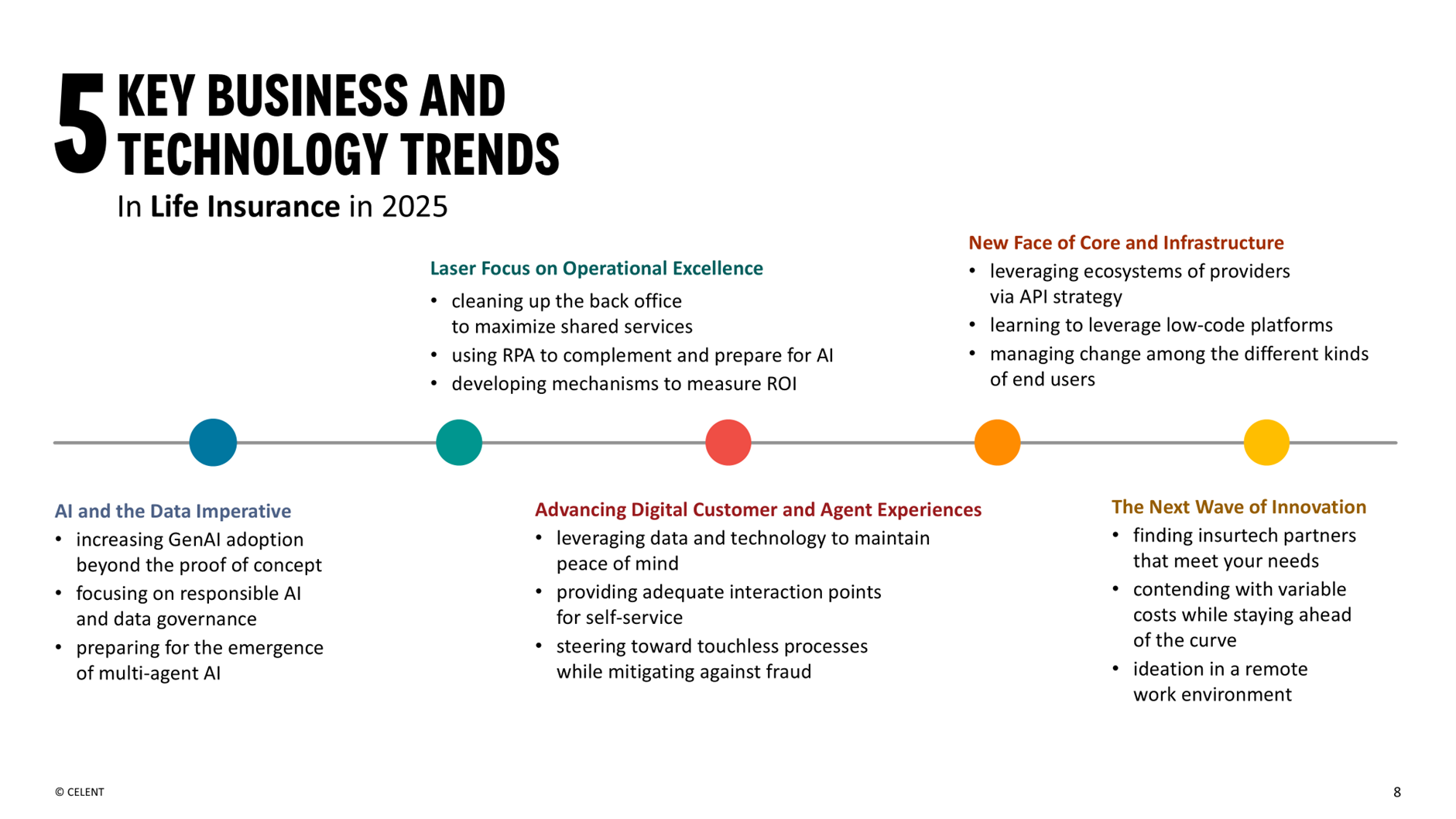

In 2025, insurers will focus on transformative efficiency -- leveraging artificial intelligence (including the rapidly ascending generative AI/large language model (LLM) space) as well as other forms of automation and straight-through processing to reduce the time spent on each discrete task within the enterprise. The outcome should be a sleeker insurance industry, that can offer more products to more people, at reasonable costs so that insurance is seen as a value-add – not a burden to household budgets. Celent sees five key trends powering this shift:

These five themes, which appeared in our 2025 Previsory, will guide our research agenda in the coming year. We expect 2025 to be a transformative year in insurance, buoyed by a clarity of purpose around efficiency and growth and with lessons in technology strategy, partnerships, and market dynamics from the past several years of chaos absorbed.

The challenge for insurers is that in order to meet growth objectives by leveraging digitalization, they also must make major investments in data management and governance. Insurers are also contending with a changing workforce, with experienced workers across functional areas leaving the industry via retirement. Not only do they need to be replaced, but their years of experience must be passed down to a new generation – creating another barrier to efficient operations.

In 2025, Celent research will dive into the many options insurers have to use technology to mitigate the risks associated with these challenges. We welcome our clients’ input into helping us shape these conversations, and stand ready to develop this thought leadership into actionable insight for you. That includes helping vet partners and solutions, develop strategic plans and everything in between. There’s a lot of headroom for innovation in insurance this year – let’s explore it together.

Contact us for more information about what we have planned in Q1 2025.

If you are a client, please sign in to access a detailed view of our 2025 agenda.