The Dimensions: IT Pressures & Priorities 2025 series of webinars and reports provides a look at the practical concerns and goals of financial institutions. Leveraging insights from the IT Dimensions 2025 survey, with the perspectives from more than 1,000 executives at top FIs, Celent’s analysts have taken a deep dive into areas of strategy and investment that can help organizations throughout financial services secure a competitive edge and transformative efficiency.

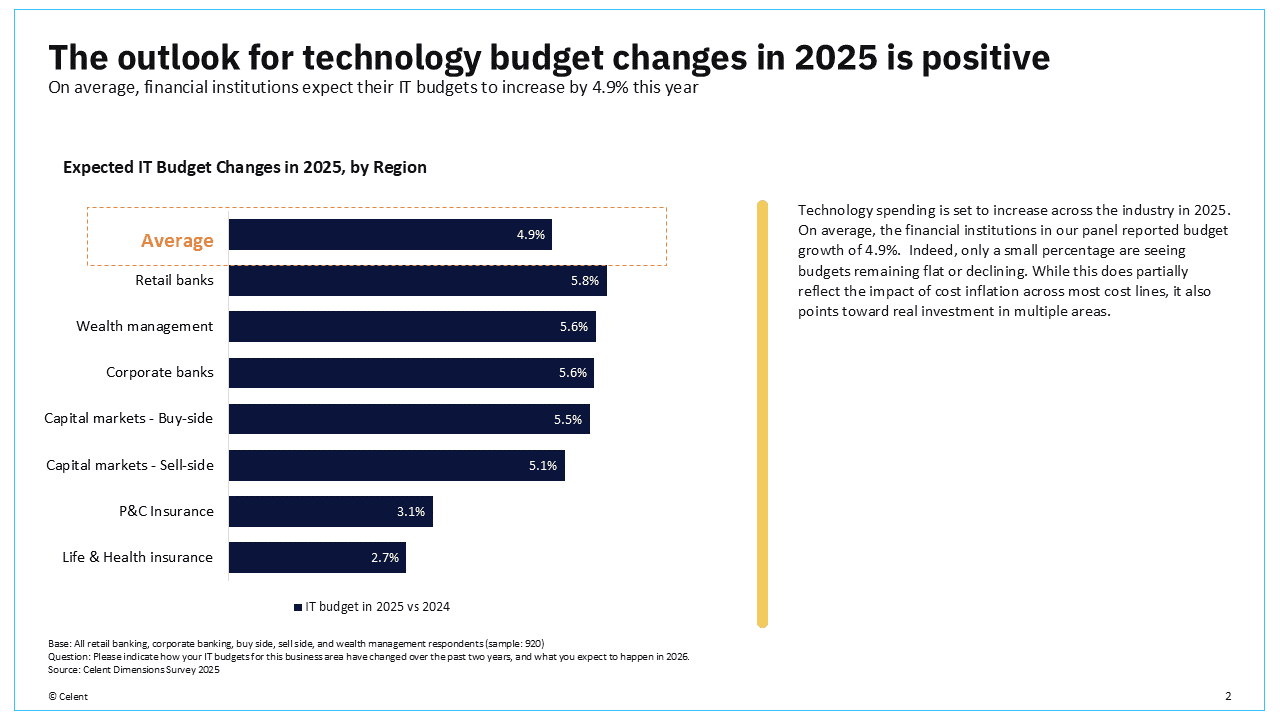

A positive outlook for financial institutions’ IT budgets The outlook for technology budget changes in 2025 is positive overall. On average, financial institutions expect their IT budgets to increase 4.9% this year. Only a small percentage of survey respondents see budgets remaining flat or declining.

The Dimensions webinars (presented over the past few weeks and available on-demand) evaluate specific trends, insights, and forecasts, by industry. Investment priorities, the amount of investment, areas of innovation, projected budget changes and perceived constraints, and emerging technologies are some of themes addressed for each industry. (Note that overall priority doesn’t necessarily reflect the level of investment.)

Each webinar is the tip of the iceberg, chock-full of relevant findings. The accompanying Dimensions reports provide deeper evaluations of industry considerations. Additional reports, with regional cuts on the data, are also part of the series; some are available now while others will be published soon.

Some of the recurring themes we heard across industries include:

- AI: No surprise, conversations about artificial intelligence are ubiquitous these days—and crucial for financial services. The prevalence of AI; applications of AI overall and of generative AI (GenAI), specifically; areas of investment for AI functionality; barriers for implementation; factors for successful scaling of AI; AI governance structures; and the growth of AI centers of excellence are among some of the specific considerations addressed in the Dimensions series.

- Emerging tech trends: What will the coming five years look like across financial services? There’s some variation across industries, but expectations for the medium term reveal some recurring themes that we’ll continue to track and monitor. “Open” ecosystems remain a common interest area — especially when it comes to top product investment priorities: open ecosystems, open data integrations, open banking, open finance, open standards, and open insurance, for example. Software-as-a-service (SaaS) utilization, cloud enablement, and advanced data analytics are among other areas of focus.

- Where concerns are easing: Compliance, for example, remains a priority, although with some signs indicating that investment focus is switching away from large spend projects towards incremental spend on AI-fueled innovations matched to leverage existing assets and data. We’re also seeing shifts in “run the business” and “change the business” allocations of IT spending, compared to past years, illustrating areas where FIs may be more at ease to pursue innovation. For example, in capital markets, more than half of IT spending budgets was allocated to “run the business” activities recently (56% in 2023, 53% in 2024), but there’s now a 50%/50% split with “change the business” activities.