2024年初めにセレントが実施した調査によると、キャピタルマーケッツ金融機関の半数近くが、2024年度のテクノロジー戦略において「スピードとアジリティの向上」を優先課題のトップ3に挙げた。政治的、市場的、規制的のいずれにおいても、今年起こった出来事によって、この優先課題の妥当性が明らかになった。セルサイド企業は、テクノロジー投資を通じたアジリティの確保とに力を入れてきたが、顧客中心の製品イノベーションへのシフトとキャピタルマーケッツエコシステムの進化により、ビジネスへのオプション提供を優先する傾向になっている。

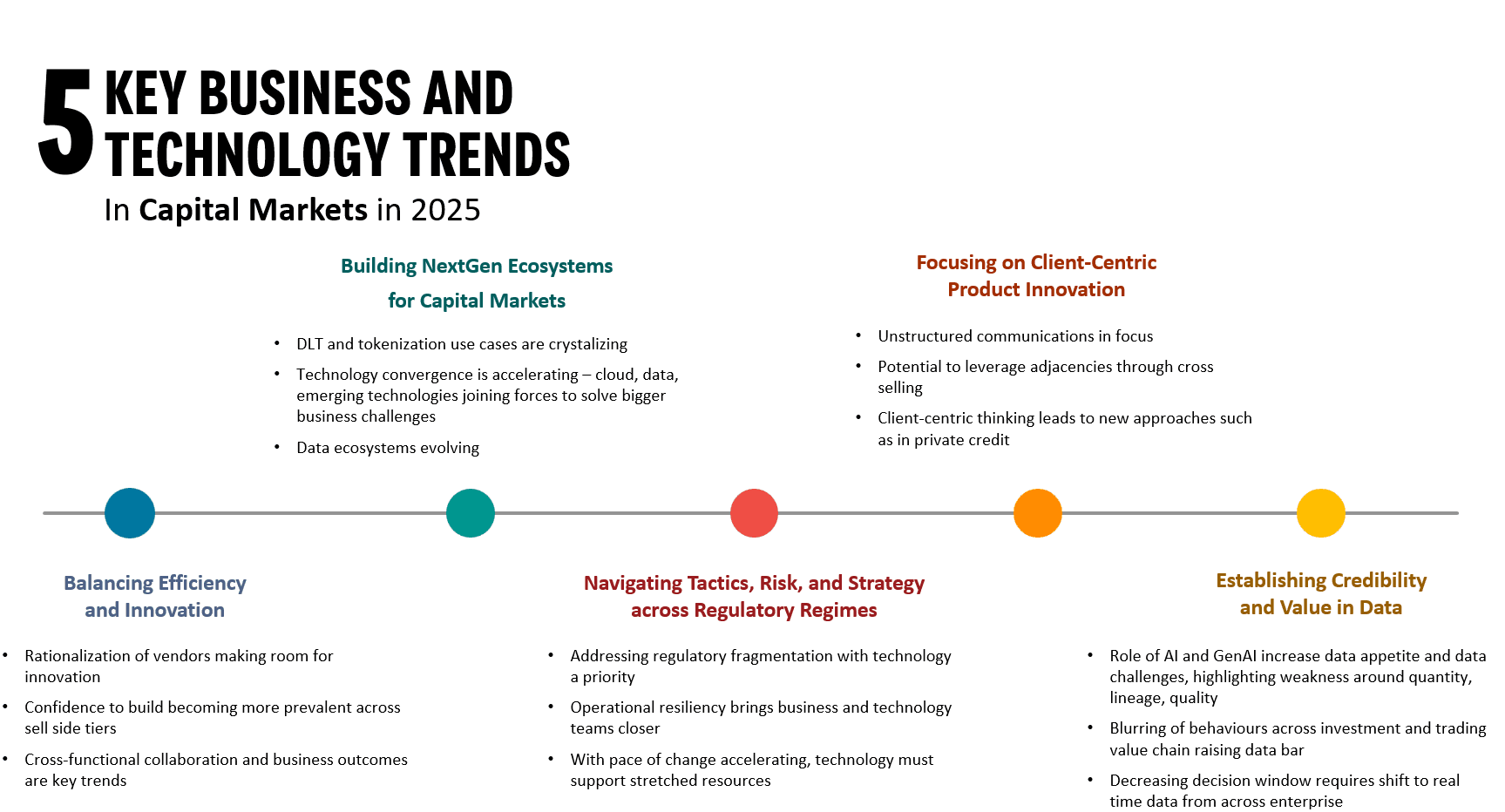

当社の年次プレバイザリーにおいて、当社キャピタルマーケッツ・チームは、独自のリサーチとネットワークを駆使し、2025年にキャピタルマーケッツ全体におけるテクノロジー戦略や投資を促進するビジネステーマを特定する。2025年については、キャピタルマーケッツ全体でテクノロジー投資を促進する鍵となる5つのビジネストレンドを特定し、本レポートではセルサイド企業にとっての重要ポイントを評価した。

関連レポート一覧:

- TOP TECHNOLOGY TRENDS PREVISORY 2025:キャピタルマーケッツ / バイサイド編

- ウェビナー:DIMENSIONS:キャピタルマーケッツにおけるITの課題と優先事項:2024年版

- 流れを変える:トランザクションレポート市場の全体像

- 資本市場におけるポストトレード業務の未来像

- オルタナティブ投資とプライベートマーケット:次世代のオペレーショナルエコシステムのための新たなテクノロジーのフロンティアとデジタルパスウェイを描く

- 厳しい視線が注がれるESGの達成:「約束を実行」し、信頼性ギャップを解消

- 2025年エンタープライズ・データ・マネジメントの展望 : パート1 and パート2

- キャピタルマーケッツにおける生成AIの先駆者たち

バイサイド、セルサイド、マーケットインフラのトレンドやテクノロジーに関する詳細なリサーチについては、当社ウェブサイトのキャピタルマーケッツページで閲覧可能。