2025 will be another year of change and opportunity for retail banking. Technology budgets are expected to increase by over 5% on average, as institutions look to push ahead in unlocking efficiency improvements across their estates, while also delivering enhanced products and experiences to customers.

Building the foundations for next-generation banking is a growing priority, and the degree to which banks are successful at delivering simplification, modernisation, and resilience will influence the shape of the future competitive landscape. Indeed, the impact of making the right (or wrong) technology choices has never been greater. Public cloud, modern data platforms, cybersecurity, and AI in all forms remain some of the highest priority technology investment areas for the industry, and this will continue in 2025.

These changes will be delivered in what remains a challenging operating environment. A return to relative economic stability is welcome but will bring a further squeeze on margins as interest rates continue to fall. In addition, there remains considerable potential for further political instability, which may reduce consumer and business activity. Banks must also balance their growth plans against the need to meet a growing compliance burden. New requirements covering resilience, security, payments, data, and AI are all coming down the pipe and will consume resources.

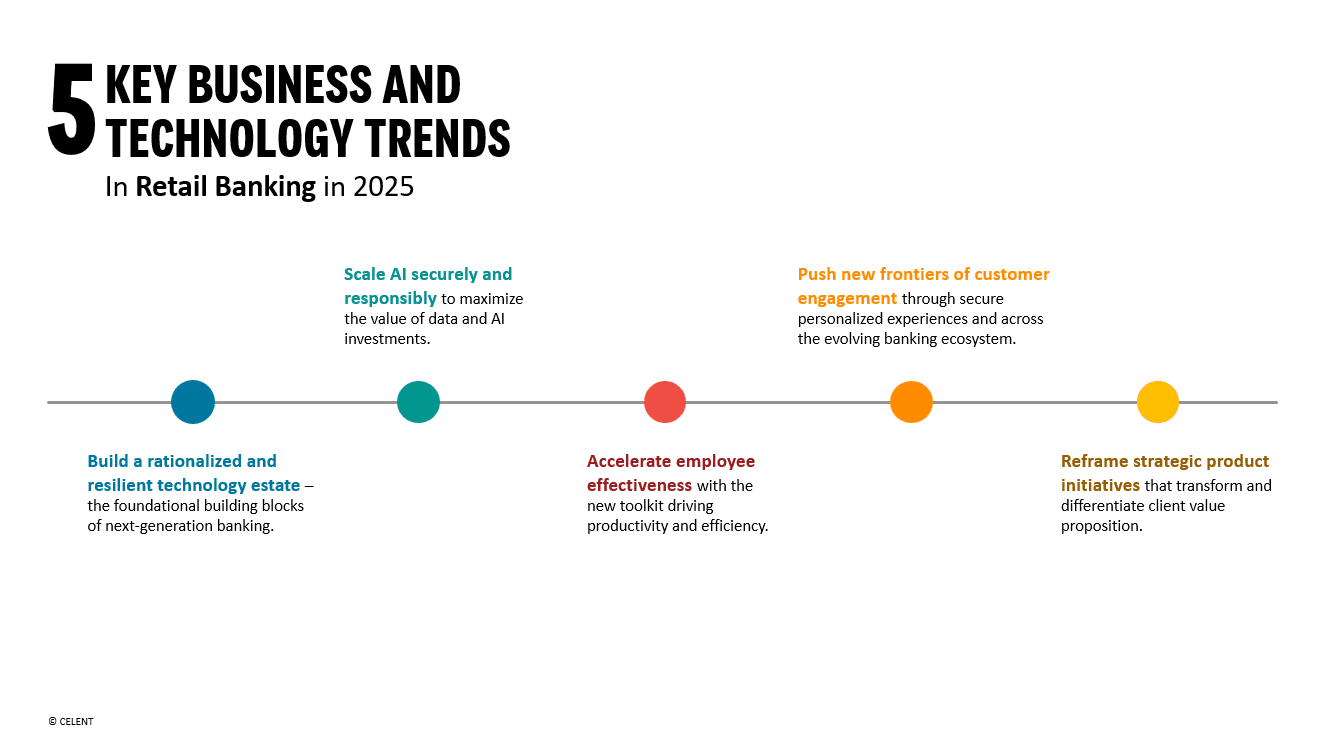

Celent has identified the five business and technology trends that will dominate the industry in 2025. Each is covered in detail and will be expanded further in Celent’s research agenda for the year ahead.