Financial institutions around the world are focusing increasingly on open APIs and data usage as new business areas with great potential. This report examines the most promising technologies and ecosystem creation related to these areas—open APIs and data usage. This is the sixth installment in the digital transformation series reporting on possibilities related to legacy and ecosystem migration and innovation and emerging technologies in the Japanese financial and banking industry.

In 2002, Amazon founder Jeff Bezos issued what has since come to be called the “Amazon Mandate.” The document was sent to all Amazon employees and required they proactively use APIs, mandating the following:

“All teams will henceforth expose their data and functionality through service interfaces. Teams must communicate with each other through these interfaces. All service interfaces, without exception, must be designed from the ground up to be externalizable. That is to say, the team must plan and design to be able to expose the interface to developers in the outside world. No exceptions.”

Some 15 years after this declaration, the open API tsunami has arrived on the shores of the most conservatively positioned sector, that of the financial services industry. Notably, in May 2017, the Japanese financial industry orchestrated a major shift in direction. Under the Amended Banking Act, a registration system for Electronic Settlement Agency Service Providers, so-called third-party providers (TPPs) of electronic payments and announced policies of collaboration between banks and TPPs. Measures concerning the promotion of open innovation at banks eventually emerged as new regulations. This turned out to be an about-face shift in Japan's financial regulations.

Celent proposes a strategic evolution it has dubbed Open API 2.0 to fully benefit from the advent of the open API era, whichwill be emerging in earnest in 2020. At the core of thisstrategy is data monetization technology (data-driven business innovation achieved through improvement to the data usage environment coupled with modernization related to system connections).

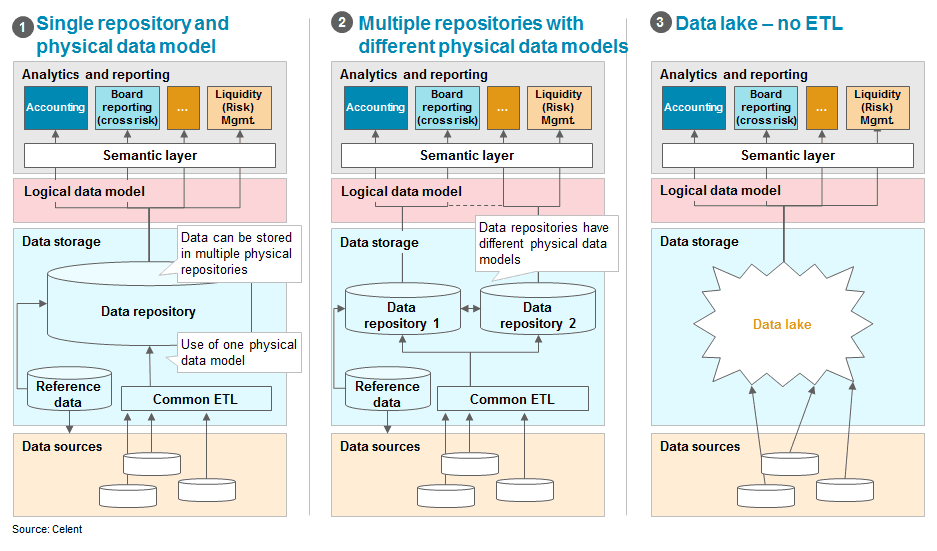

From Data Warehouse to Data Lake