Buyside firms are becoming less defensive compared to last year; however, we believe that the outlook for investing and investment managers remains tempered. Since our survey was conducted toward the end of 2024, when markets finished the year on a relatively buoyant note — we have observed that the global macroeconomic environment has become more volatile, with heightened recessionary risks stemming from global trade tensions and policy uncertainties. Traditionally, during recessionary conditions, asset managers experience more volatile outflows and declines in assets under management (AUM), as investors remain cautious, shifting to safer assets or adopting a 'wait and see' approach.

In this year’s buyside survey, the context for IT budgets for 2025 (and into 2026) reflects cautious growth and investment. While tech budgets continue to rise marginally for 2025, buyside firms’ IT priorities remain selective and highly focused on ROI. Low-digit growth is apparent across most geographical regions, with regulatory-led emphasis on technology spending coming to the forefront, characterized by pockets of directed and growth-oriented investments. Continuing from previous years, we see investment priorities directed towards large-scale cloud enablement, advanced data analytics, and digitization become essential. More firms are now looking to fundamentally change their core operations rather than simply 'tweak around the edges.'

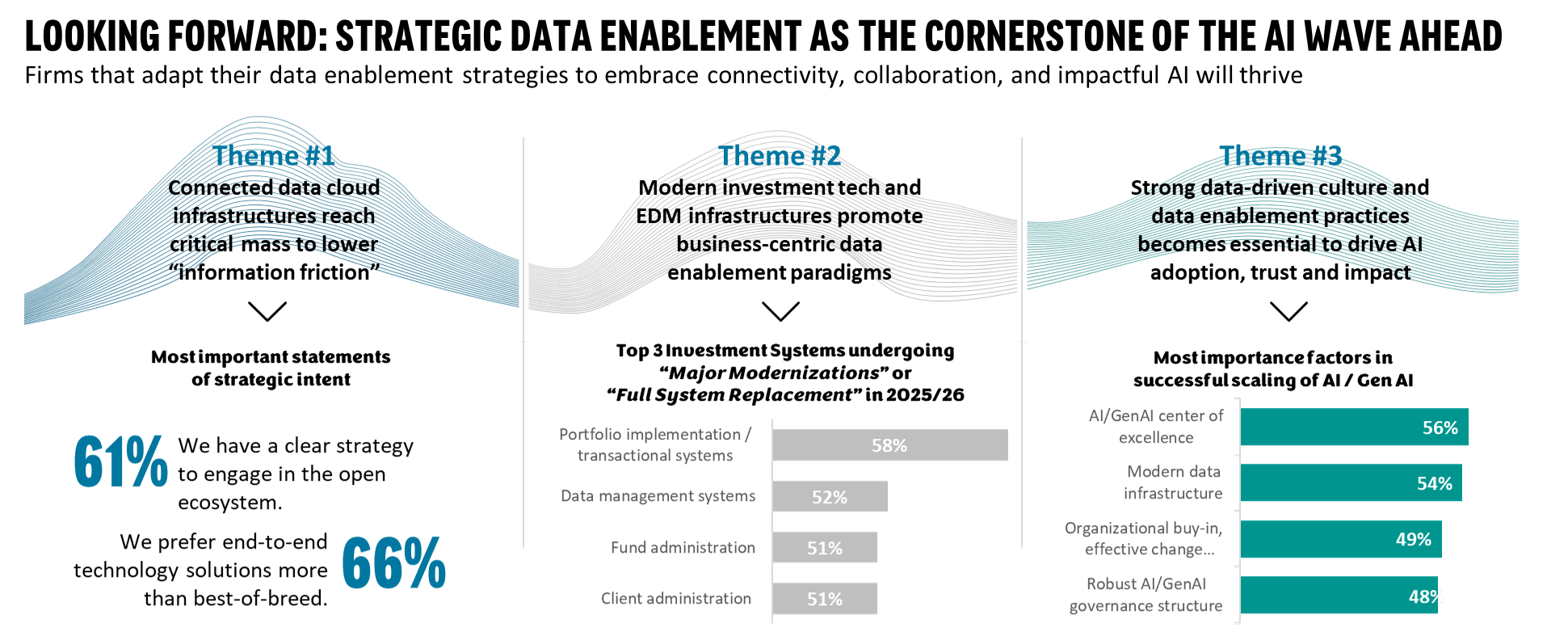

Looking ahead, all roads seem to lead to AI — this represents another wave of change that firms are still grappling with. As firms navigate beyond the hype, an increasing number are confronted with the reality that digitization, advanced data analytics, and ambitions in (Gen)AI heavily rely on robust data management and delivery. Although data enablement initiatives are not new, there is a rising sentiment that buy-side firms are refocusing on strengthening and enhancing their "data foundations" in preparation for the AI wave. This shift reflects the understanding that data enablement is now regarded as a crucial stepping stone toward adopting more sophisticated analytical capabilities, including Gen AI and machine learning.

Data-AI gaps persist, and this issue is particularly relevant in addressing the current challenges related to data risks, trust in AI, and biases in decision-making. To drive success in this complex landscape, forward-thinking firms are focusing on revitalizing their data strategies. They are empowering the business, pursuing the most salient / highest-value use cases, and investing in modern cloud data infrastructures to maximize the ROI associated with their AI initiatives.

In this year's "Dimensions Buyside IT Strategy & Priorities 2025" report, we provide insights into the specific technologies, product investments, and strategic priorities that shape the agendas of global buyside firms across North America, Europe, Asia, and emerging markets. This analysis is based on survey data collected from a diverse range of stakeholders, including asset managers, insurers, hedge funds, alternative managers, pension funds, and sovereign wealth funds. By understanding industrywide trends across peers, firms can better align their strategies with the evolving demands of the market.

----------

Subscribing clients can access the full report through their Capital Markets research membership. For more in-depth research around future buyside, sellside and market infrastructure trends and technology insights, please explore Celent's Capital Markets practice.

Relevant companion studies from Celent's body of research insights include:

- Top Technology Trends Previsory (Capital Markets): Buy Side, 2025 Edition

- Field Guide to GenAI Hyperscalers: Capital Markets Edition

- GenAI-oneers in Capital Markets: FI Survey on adoption and impact

- Enterprise Data Management Visions and Trajectories: Capital Markets and Investments Edition Part 1 and Part 2

- Overcoming Fractured Data Chains and Achieving Operational Brilliance in Private Markets

- Alternatives and Private Markets: Charting new technology frontiers and digital pathways for next-gen operational ecosystems

- Pivoting to the Front: The Quest for Greater Differentiation as the Alpha Race Intensifies

- Private Credit, Sustainable Investing & Outsourced Management Remain in Focus

- ESG Delivery Under Scrutiny: "Walking the Talk" to Resolve the Credibility Gap

- NextGen Investment Accounting Solutioning Guide: A Playbook for Success

For over 20 years, Celent has helped senior executives make confident decisions around their technology strategies to execute at scale.

As the financial services industry rapidly evolves, there is more complexity, with new regulations, startups, technologies, and applications to stay on top of and prioritize. Celent helps you connect this ever-changing puzzle. We offer objective advice and clarity, backed by a database of thousands of solutions and award-winning global best practice use cases. With real-life domain expertise, we also guide you through the maze of emerging tech in the pursuit of value.

Our people, data, insights, and relationships form the foundation for you to use Celent to make confident technology decisions in financial services.