I spend a certain amount of time in Palo Alto. For a while now, a common sight has been Waymo vehicles (with a safety driver) tooling around town. Traffic in Palo Alto is mostly calm and orderly, stoplight and street signage are well maintained and quite visible, and pedestrians often wait for “Walk” signals to cross the street. In short, it is a driving environment which poses relatively simple challenges to human drivers and to autonomous vehicles.

These completely unscientific observations, certainly not based on any statistically valid analysis, do suggest something about the development of autonomous vehicles; and indirectly about the end of auto insurance.

But, first let’s zoom out for a bit of history, specifically the history of Celent’s thinking about the end of auto insurance.

Seven years ago, in May 2012, Celent did some thinking in a report A Scenario: The End of Auto Insurance: What Happens When There Are (Almost) No Accidents? That report concluded:

- Celent believes that this scenario is plausible, and that the probability of [a substantial reduction in auto insurance premium] occurring is sufficiently high that auto insurers should devote some resources to considering the scenario and its implications for their business model and enterprise.

Three years ago, in June 2016, Celent did some rethinking of its earlier report. It published an update, The End of Auto Insurance: A Scenario or a Prediction?, expressing more confidence in its conclusions and recommendations:

- During the next 15 years, auto insurers will likely see their business shrink (and continue to shrink thereafter as driverless cars become a larger part of the fleet). Some insurers are beginning to address this existential challenge now. The rest will have to do so in a few years.

Since 2016, events have moved rapidly—with mixed impact on the timing of the end of auto insurance. These events have made some re-rethinking necessary. Celent’s new (August 2019) report, Re-Rethinking the End of Auto Insurance, looks at:

- How a substantial number of acquisitions, investments, and alliances among automobile manufacturers’ autonomous vehicle development efforts suggests that very few manufacturers believe they can develop and deploy autonomous vehicles without very large combined resources.

- A dramatic shift of many autonomous vehicle developers to initial deployment of autonomous vehicles as robotaxis, rather than of vehicles owned and used by individuals. Significantly these robotaxis typically operate in geo-fenced areas with relatively simple driving conditions (a bit like Waymo’s test vehicles in Palo Alto).

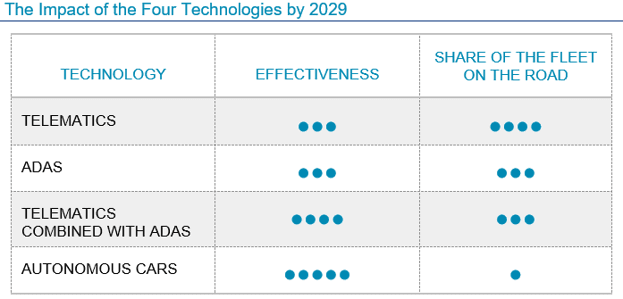

- How two other technologies ADAS (aka on-board collision avoidance technologies) and telematics will become more common in the fleet of vehicles on the road, and will reduce accidents.

Here is what Celent thinks now:

- ADAS, telematics, and autonomous technologies will be very effective in reducing accidents, auto insurance losses, and auto insurance premiums

- The proportion of these technologies in the fleet on the road, will grow over the next 10 years

- ADAS and telematics will grow relatively quickly.

- Autonomous vehicles will grow much more slowly.

The end of auto insurance (let’s say a very material decline in the size of the auto insurance industry) is still going to happen, but the good news is that the auto insurance industry has more time to adjust.

More good news is that the development of connected cars is creating the possibility (or perhaps the necessity) of finding new products and services to offer policyholders.

Now all the industry has to do is . . . plan . . . and execute.