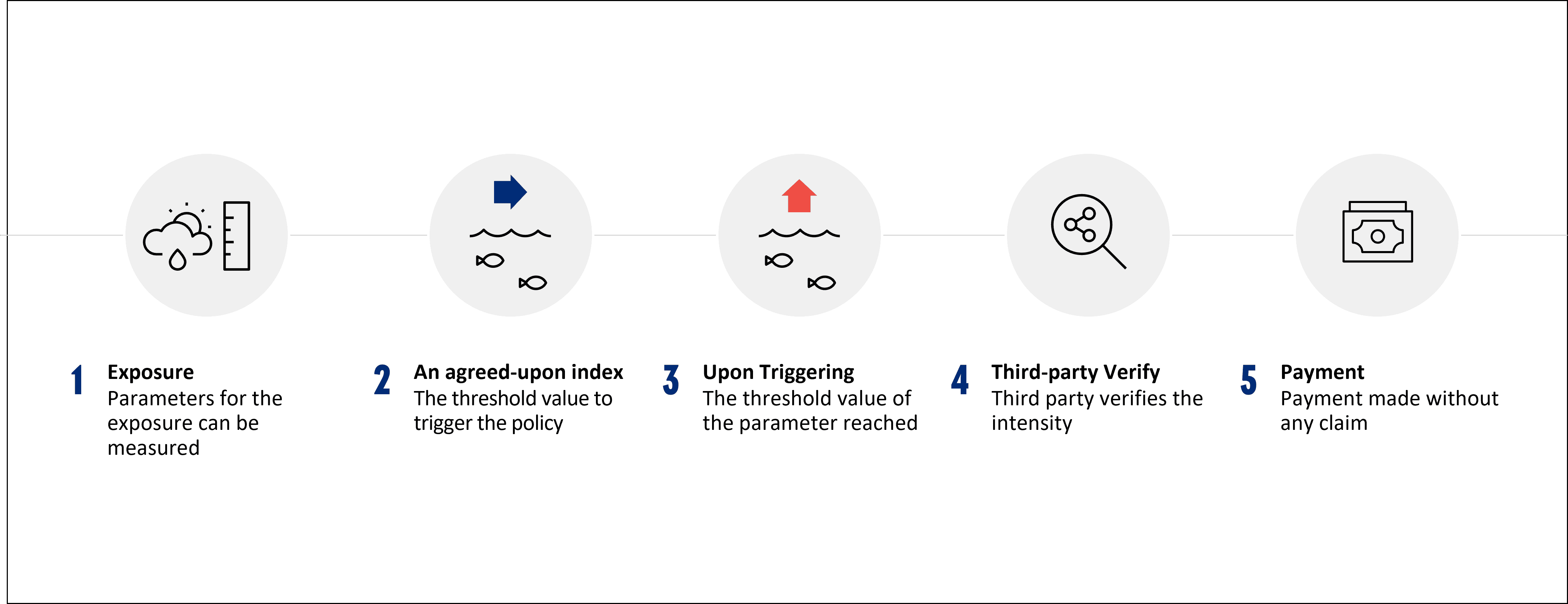

Parametric insurance is a groundbreaking risk management tool designed to revolutionise the insurance industry by offering efficient, rapid payouts based on predefined parameters. Parametric insurance pays out a predetermined amount if a specific event occurs; unlike traditional insurance, which typically requires a claims adjuster to assess the damage and determine the payout, parametric insurance uses objective, measurable data to trigger the payout.

This research delves into the fundamental principles of parametric insurance, exploring its innovative approach to mitigating risks associated with natural disasters, weather events, and other volatile occurrences.

It also analyses how parametric insurance functions, highlighting its distinctive features, benefits, and limitations. It examines case studies illustrating successful implementations of parametric insurance across various sectors and geographies. Furthermore, it investigates the growing adoption of parametric insurance in the face of increasing climate uncertainty and changing risk landscapes.

Tile Photo by Kelly Sikkema on Unsplash