The investment sector is experiencing a profound transformation, driven by advancements in data capabilities and nascent AI integrations. The acceleration of digitization, AI, and strategic data insights has reinvigorated the emphasis on data enablement within capital markets, fueled by strong imperatives and increased funding for next-generation, cloud-enabled investment data infrastructures.

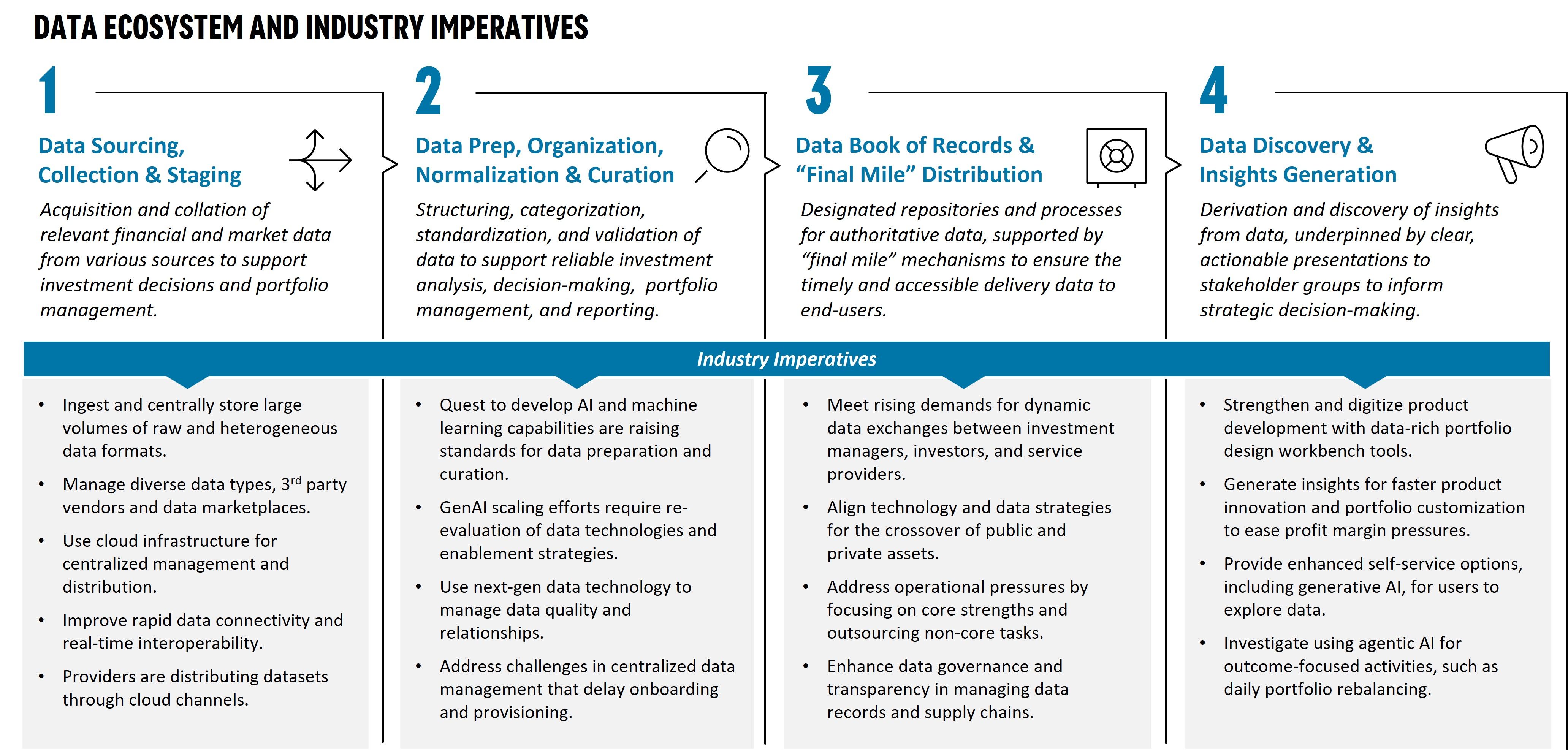

While data enablement has always been crucial, the increasing prominence of AI on corporate agendas is refocusing attention on fundamental data management practices. Although firms must invest to resolve current challenges — with ongoing efforts to revise data strategies to overcome the limitations of legacy systems and to satisfy regulatory and customer requirements — there is now a heightened urgency to prepare and integrate AI capabilities. This is no longer a nice to have. Successful adaptation demands innovative approaches to manage the entire data lifecycle—from capture and validation to curation and real-time processing—within a rapidly changing technological landscape.

New possibilities and propositions are emerging throughout the data chain. Forward-thinking investment firms are pivoting to revitalize their data strategies by investing in modern data infrastructures to maximize the return on investment associated with their AI initiatives. Even firms that have utilized investment data science and traditional (statistical-based) AI/machine learning techniques over the last decade (such as systematic or quantitative hedge funds) are intensifying their efforts and refining their methodologies to explore and incorporate synergies with Generative AI.

Celent expects several industry dynamics to evolve and shape the implementation of data enablement strategies in the years ahead:

- The swift adoption of cloud-based data infrastructures is creating new avenues for connectivity and collaboration across trading and investment ecosystems.

- Modern enterprise cloud data management solutions now promote user-centricity and domain-oriented data ownership, allowing organizations to treat data as a strategic asset.

- Investment managers who are leading the way are actively rethinking their data strategies to prioritize AI across all aspects of their operations.

The report explores the emerging landscape of investment data ecosystems, focusing primarily on the role of different ecosystem provider archetypes in optimizing data enablement strategies. As organizations strategically transition towards enhancing their data enablement capabilities, this evolution necessitates that investment firms navigate and comprehend the numerous nuances of provider platforms and go-to-market strategies. Firms must learn how to effectively leverage ecosystem provider archetypes to achieve the most significant impact in their data enablement efforts. We present and highlight key considerations and success factors when selecting new investment data platforms.

----------------------

Subscribing clients can access the full report through their Capital Markets research membership. For more in-depth research around future buyside, sellside and market infrastructure trends and technology insights, please explore Celent's Capital Markets practice.

Other companion studies include:

- Top Technology Trends Previsory (Capital Markets): Buy Side, 2025 Edition

- Enterprise Data Management Visions and Trajectories: Capital Markets and Investments Edition Part 1 and Part 2

- ESG Data Management in Capital Markets: A Time of Opportunity

- Overcoming Fractured Data Chains and Achieving Operational Brilliance in Private Markets

- NextGen Investment Accounting Solutioning Guide: A Playbook for Success

- ESG Delivery Under Scrutiny; “Walking the Talk” to Resolve the Credibility Gap