Everyone knows the importance of making a good first impression. Doing so at scale through digital-first customer engagement is today's clarion call for retail financial institutions - particularly for new-to-bank customer acquisition.

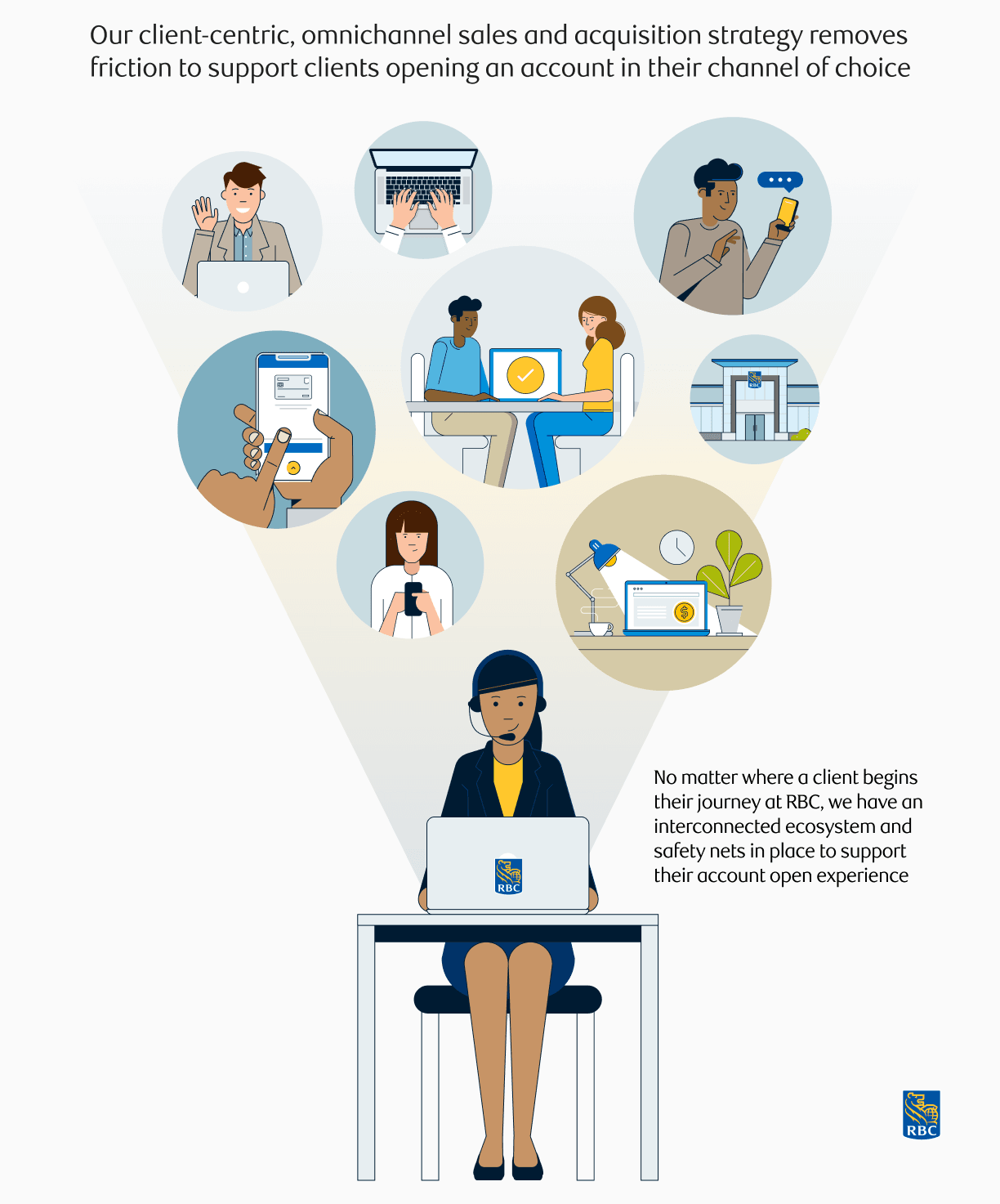

To maximize growth in new-to-bank client relationships, RBC built an omnichannel client acquisition ecosystem using a modern technology stack with reusable applications built atop a single sales backbone and supported by systematic onboarding, automated cross-sell, and a team of client acquisition specialists to support these new client relationships.

RBC’s design reflects the reality that customers choose a diversity of user experiences—all of which must be delivered with excellence for longevity of customer relationships and to maximize lifetime customer value. RBC's approach works! The bank surpassed its 2023 new-to-bank client growth objectives by 77% alongside dramatic growth in savings and card cross-sell rates.