Now that the impact of the pandemic has begun to recede, banks in Europe are back to focusing solely on growth. While there are both political and macroeconomic challenges ahead, innovation tops the agenda for 2022, and technology investment will underpin much of this change.

With all the talk of the industry moving to a 'New Normal', Celent launched its Banking IT Strategy Survey (CBISS) at the end of 2021 to understand exactly what this means. Through a series of detailed conversations with close to 200 retail banks, we have captured granular insights into the technology strategies and investment priorities of the industry. One thing is clear; there is no suggestion that technology spending will slow any time soon. Financial institutions across Europe report strongly expanding IT budgets for 2022, and these are being applied to a range of enhancements to product development, the user experience, and improvements to operations.

On average, technology spending in 2022 will be 4.0% greater than 2021, and the expectation is that budgets will increase by an even larger amount in 2023. This reflects a growing appetite for technology-enabled growth, as the industry accelerates away from the pandemic. It also highlights the imperative for banks to accelerate their own transformation plans in order to remain relevant in what is a rapidly changing landscape.

This report provides detailed perspectives on the investment and strategic imperatives of banks in Europe.

Key findings include:

- 74% of banks believe that the threat from fintechs and challenger banks is greater than a year ago

- 54% are investing in their capabilities around open banking as a priority for 2022

- 53% cite migrating workloads to public cloud infrastructure as a technology priority

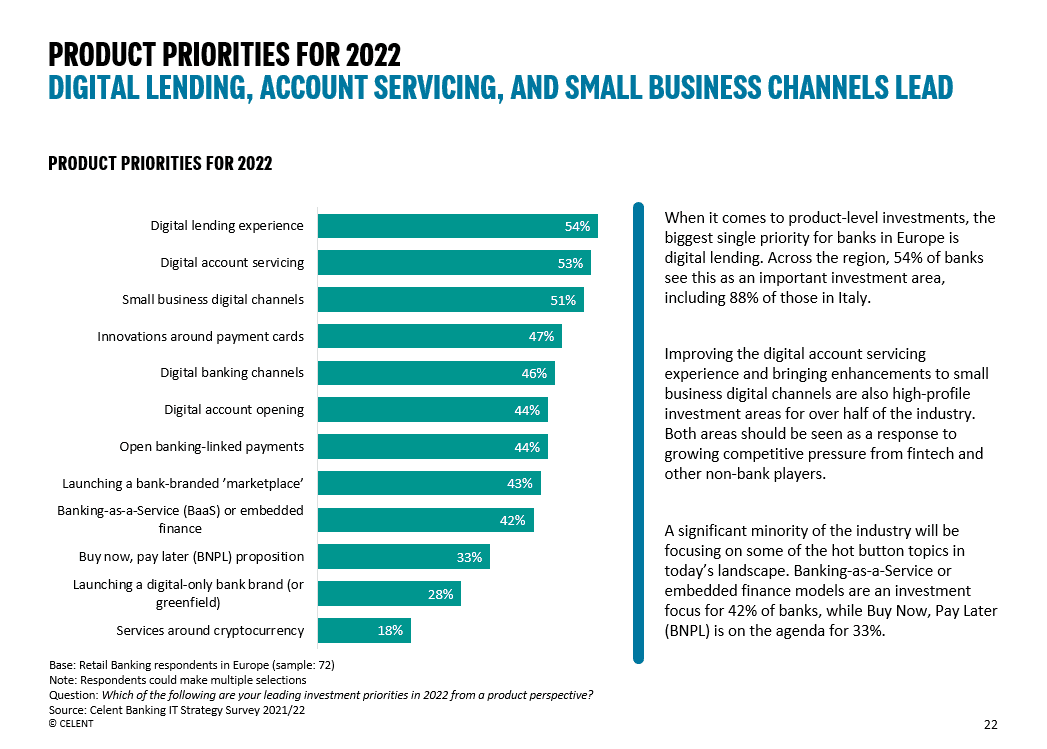

- 54% of banks are investing in the digital lending experience, making it the single biggest product priority

- 81% report that their institution has a clear strategy to engage with the open ecosystem

The lessons for the industry are clear. Funding innovation is a major strategic driver for banks in Europe. Banks that don’t invest risk falling behind the market.

For over 20 years, Celent has helped senior executives make confident decisions around their technology strategies to execute at scale.

As the financial services industry rapidly evolves, there is more complexity, with new regulations, startups, technologies, and applications to stay on top of and prioritize. Celent helps you connect this ever-changing puzzle. We offer objective advice and clarity, backed by a database of thousands of solutions and award-winning global best practice use cases. With real-life domain expertise, we also guide you through the maze of emerging tech in the pursuit of value.

Our people, data, insights, and relationships form the foundation for you to use Celent to make confident technology decisions in financial services.