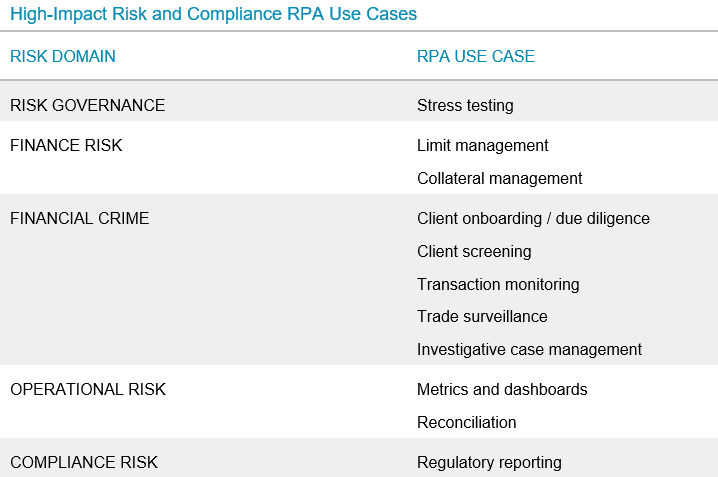

There are an abundance of tasks across risk and compliance operations that can be automated using robotics. But early implementations are not providing the expected results. The disappointment with early implementations is not a reflection of RPA as a technology. Rather, it is a lack of good governance and advance planning.

A typical bank employee makes 10 to 30 errors per 100 opportunities. Now consider a top UK-based global financial institution that employs 12,000 fraud anti-money laundering (AML) and compliance analysts. The math is alarming. RPA, as a set of technologies that enables the automation of tasks currently requiring human involvement, is a compelling business approach to the problems of staffing, risk mitigation, and the management of compliance.