Through most of its history, Ascot Group has primarily been a Lloyd’s Specialty Wholesale Insurer, with much of its business originating in the United States. It recently decided it also wanted admitted and non-admitted access to some of that US-sourced business, so it established an insurance company in US.

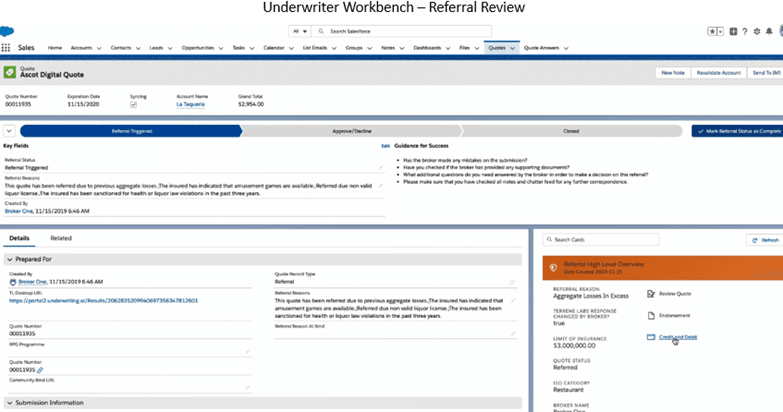

Believing that “if an underwriter spends more than 10-15 minutes on a submission, both Ascot and the broker will lose money on those accounts,” Ascot decided to develop a solution, Ascot Array. Ascot Array enables automated portfolio underwriting, which it defines as a process which mitigates human bias, and allows for a structured designed process to evaluate submissions quickly and efficiently.