A webinar on this topic is also available.

Blockchain in corporate banking is moving from experiment to live transactions, proving value and feasibility but not yet demonstrating viability (e.g., scale). Celent showcases 12 contenders in payments, trade finance, and syndicated loans.

Early movers have gone from proofs of concept to pilots and production. The production launches are currently relatively small initiatives.Most initiatives are digitizing processes, that is, carrying messages or documents. Only a very few are using digital assets as a medium to exchange value. The next 18 months will be a critical period to attract service providers and end users. In parallel, blockchain and DLT platform providers are working fervently on improving scale and speed with the goal of staying one step ahead of the needs of application providers.

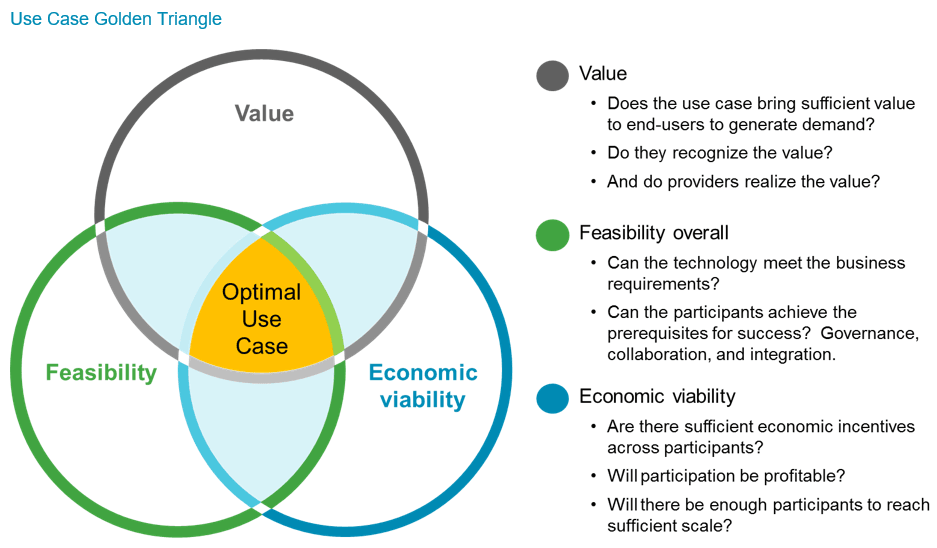

Celent has selected 12 contenders to profile based on their progress toward winning medals in value, feasibility, and viability as well as the caliber of their people and participants.

- Five in cross-border payments with the first three in production: Ripple, Stellar, IBM World Wire, JPM Interbank Information Network, and Visa B2B Connect

- Six in trade finance with the first two in production: we.trade, India Trade Connect, TradeIX, Skuchain, Voltron, and Centrifuge

- One in syndicated lending in production:Fusion LenderComm by Finastra

For over 20 years, Celent has helped senior executives make confident decisions around their technology strategies to execute at scale.

As the financial services industry rapidly evolves, there is more complexity, with new regulations, startups, technologies, and applications to stay on top of and prioritize. Celent helps you connect this ever-changing puzzle. We offer objective advice and clarity, backed by a database of thousands of solutions and award-winning global best practice use cases. With real-life domain expertise, we also guide you through the maze of emerging tech in the pursuit of value.

Our people, data, insights, and relationships form the foundation for you to use Celent to make confident technology decisions in financial services.