With the acceleration of digital access in financial services, fraud technology has developed into a complex ecosystem of solutions aimed at securing customer accounts and transactions. At the same time, enhanced AI capabilities, including generative AI-based techniques such as large transaction models (LTMs), are providing financial institutions with additional tools to fight an increasing number of specific new fraud schemes and the growing technological sophistication of criminal fraud rings. Celent estimates that the need to support these capabilities will drive 6.9% year-on-year growth in fraud IT spending to reach US$21.3 billion in 2028.

This report, based on data from the Celent Technology Insight and Strategy Survey (CTISS) survey undertaken in 2023, provides our estimates of investments in anti-fraud technology—as well as operational spending on fraud functions—by financial institutions worldwide, including banks, insurers, broker-dealers and wealth and asset management firms. The report presents global estimates and breakdowns including:

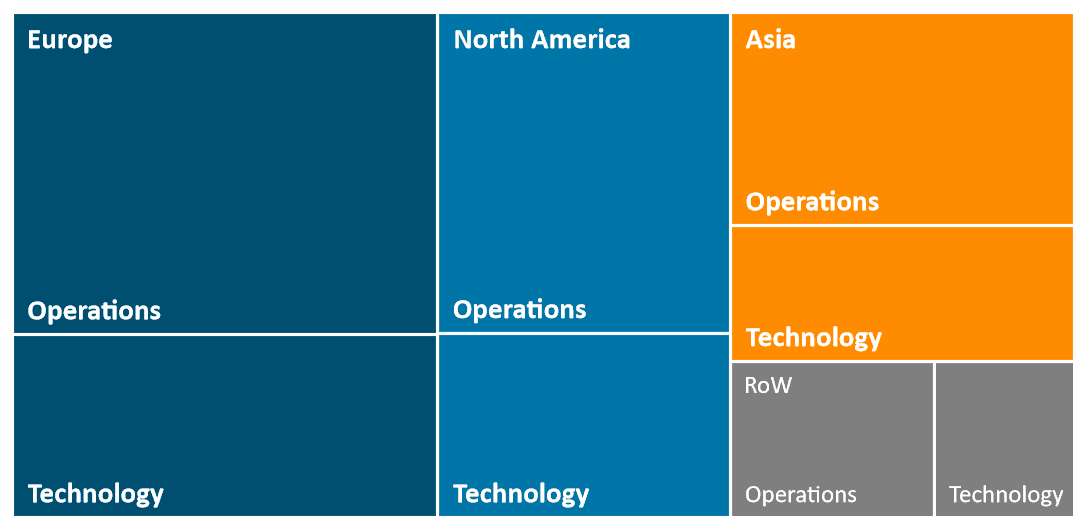

- Spending by global region: North America, Europe, Asia, and the Rest of the World.

- Technology spending breakdown by: external software, external services, internal spending and hardware/infrastructure.

- Operational spending trends.

- Spending by type and size of financial institution.

- Spending on new initiatives vs. run-the-bank maintenance activities.

- Key technology trends and imperatives for financial institutions and solution providers in 2024.