Wings of a Butterfly: Regulation, Rollovers, and a Wave of Optimization Software

Abstract

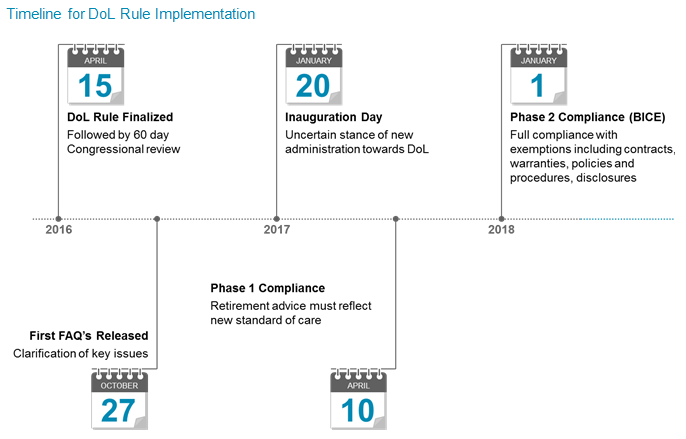

For years, advisors have treated 401(k) accounts as a feeder system for generating lucrative IRAs. The $7 trillion IRA market has shifted in the wake of the DOL conflict of interest rule, however, as the recommendation to roll over must be justified from cost, performance, and risk perspectives. A number of technology solutions have been launched in recent months to meet this compliance challenge.

Celent has released a new report titled Wings of a Butterfly: Regulation, Rollovers, and a Wave of Optimization Software. The report was written by Will Trout, a Senior Analyst with Celent’s Securities & Investments practice.

By eliminating the regulatory fault line between advised (fee-based) and transactional (or commission-based) business in retirement accounts, the Department of Labor (DoL) has accelerated a shift in industry mindset. The product-based sales approach is becoming a goals-based, client-centered, and technologically driven worldview.

Asset managers have found themselves squeezed, but the whole financial services value chain is engaged, with pressure channeled from the advisor to the fund provider all the way up to the sell side.

The most robust solutions use connective tools such as CRM to identify issues at the client level, versus product or even account level. Rollover analysis and recommendations must be incorporated into a firm’s broader advice engine. This means integration with account aggregation tools to enable the delivery of advice on the whole of the client’s assets.

“The spirit of the DoL rule has transcended the halls of Congress. Even the term ‘fiduciary’ is on the lips of Main Street investors. It is hard to envision firms arguing that they are no longer bound to act in the best interests of the investor,” Trout commented.

“How should the advisor determine what is in the client’s best interest? Such a question might appear circular or absurd to those used to operating from a fiduciary standpoint. But many brokers are not used to doing so, and the risks of regulatory and legal sanction make this a serious matter,” he added.