State of Remote Deposit Capture 2008: Sprint Becomes a Marathon

Abstract

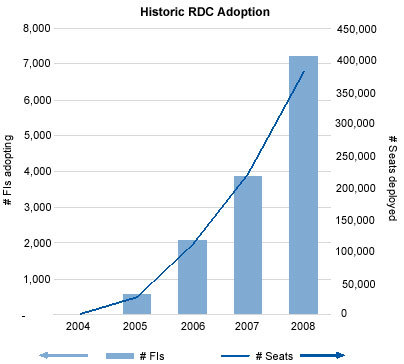

The past year has seen remarkable remote deposit capture solution adoption among midsize banks, community banks, and credit unions. By the end of 2008, two-thirds of all US banks and 40% of all US financial institutions will have adopted RDC.

Remote deposit capture’s race to market in 2005 came with great excitement, but not without costs. After the initial rush, many financial institutions have stepped back, making sure they are ready for the long haul. Products and platforms are being revisited, along with procedures, staff training, customer support, device deployment, and pricing. The resulting climate is markedly different even from than one year ago. RDC adoption will continue to grow unabated, but at a slower rate than previously predicted. The sprint has become a marathon.

Over 3,000 new implementations will result in an estimated 7,200 RDC-deploying financial institutions through 2008, according to a new report

"Celent finds the RDC market still relatively untapped, with no indication of overstatement in earlier estimates of market opportunity, as many as 5 million capture points by 2014," says Bob Meara, author of the report and senior analyst with Celent’s Banking Group. "What is now clear, however, is that realization of the market opportunity will take longer than originally thought, particularly considering the tumultuous conditions of the US financial services industry."

The 74-page report contains 25 figures and 22 tables. A table of contents is available online.

of Celent's Corporate Banking and Retail and Business Banking research service can download the report electronically by clicking on the icon to the left. Non-members should contact info@celent.com for more information.