OTC Derivatives Operations: The Path to STP

Abstract

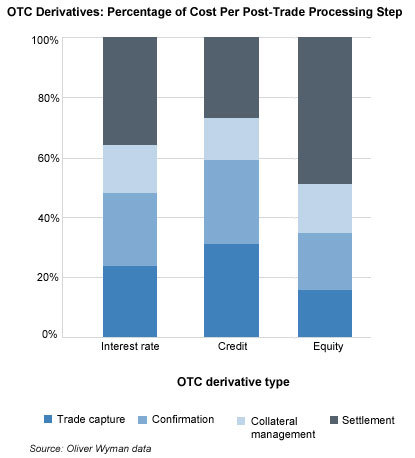

While trade capture and confirmations/affirmations still constitute over 50% of OTC post-trade processing costs, the buy side desires technology which addresses the post-confirmation process in order to reach the next level of efficiency.

While trade capture and confirmations/affirmations still constitute over 50% of OTC post-trade processing costs, the buy side desires technology which addresses the post-confirmation process in order to reach the next level of efficiency.

The report’s findings conclude that while trade capture and confirmations/affirmations still constitute over 50% of OTC post-trade processing costs, the buy side desires technology which addresses the post-confirmation process (the other half) in order to reach the next level of efficiency. To accomplish this feat, a wave of new and improved technology solutions must provide the appropriate architecture and components for a true path to STP.

"Beyond the boundaries of the enterprise, the buy side is in favor of centralization and user communities for STP," says David Easthope, senior analyst with Celent's Capital Markets group and co-author of the report. "Within the boundaries of the enterprise, the buy side is focused on flexible systems which can accommodate or plug in with existing systems and offer workflow and trade lifecycle monitoring. While some market participants may wish for an end-to-end solution, the immediate need is for point solutions which can fit the existing architecture of the enterprise and expand or adapt over time," he adds.

Celent identifies the fundamental building blocks of an STP solution for OTC derivatives as the following combined components: Dynamic Trade Modeling, Reference Data, Confirmation/Affirmations, Pricing and Valuation, Reconciliation Engines and Utilities, and Collateral Management

"We believe the role of event-driven architecture is what will bring all of these components together into a single framework," says Mayiz Habbal, head of Celent's Capital Markets group and co-author of the report.

This 51-page report contains 11 figures and three tables. A table of contents is available online. For more information from SmartStream please click here.

Members of Celent's Capital Markets research service can download the report electronically by clicking on the icon to the left. Non-members should contact info@celent.com for more information.