Mobile Banking Services in Western Europe

Abstract

Adoption of mobile banking should increase rapidly in major European markets. Thanks to improvements in mobile technology and high mobile phone adoption rates in Europe, banks are able to offer a wide range of added value mobile banking services.

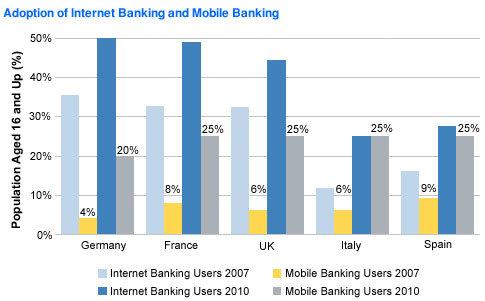

The mobile phone delivery channel represents a challenge for the European banking industry, enabling institutions to differentiate themselves from competitors, reduce costs, and develop customer loyalty. The adoption of mobile banking should increase rapidly in major European markets over the next few years, from an average of 6% today to 25% of the Spanish, French, Italian, and British markets by 2010.

In a new report, , Celent analyses the current state and potential success of mobile banking services in major European markets by providing answers to the following questions:

- What exactly is mobile banking and why does it matter today?

- What are the major adoption drivers and barriers in Western Europe?

- How are European banks becoming mobile and what strategies have they implemented?

Significant barriers remain: a general lack of awareness, technological issues, customers’ perception of security, and more significantly, the cost of mobile Internet are major hurdles to mass market mobile banking adoption. If mobile Internet usage increases, we can expect a larger number of users to interact with their banks through their mobile phones as they currently do online.

European banks have anticipated the dissolution of adoption barriers and have already launched various mobile banking services using mainly the WAP and SMS technologies. Only a few downloadable applications have been successful, mainly in the UK and in Germany. French and Spanish banks are currently offering a broader range of mobile services, followed by Italian banks. However, there are still many disparities between countries regarding the number and type of mobile banking services offered. At the European level, information and SMS services are the most common.

"The adoption of mobile banking by the mass market depends not only on the suppression of major barriers, but also on marketing and promotion from banks. Once customers recognize the benefits, the convenience, and the ease of usage, they will adopt mobile banking as they adopted online services," says Perrine Fiorina, an analyst with Celent’s banking group and author of the report.

The 39-page report contains 14 figures and 8 tables. A table of contents is available online.

Members of Celent's Retail Banking research service can download the report electronically by clicking on the icon to the left. Non-members should contact info@celent.com for more information.