HSAs: Moving Beyond the Growing Pains

Abstract

Given a disappointing early showing, the HSA market is ripe for a remodel--one that will spur growth, customer churn, and market concentration. Over the next five years, HSA growth will hover between 40% and 50%, resulting in 12.5 million accounts by 2012.

Banks, insurance companies, and third parties have built the health savings account (HSA). In fact, hundreds of companies are involved in some aspect of enabling consumers to open and use HSAs. Celent estimates that there were 1.9 million HSAs in 2007, but this number will jump to 3 million in 2008, resulting in a boost in the growth rate from 36% (in 2006-2007) to 60%. Yet growth and revenues have been disappointing for most, reflecting a classic example of shortcomings on both sides of the economic equation for supply and demand.

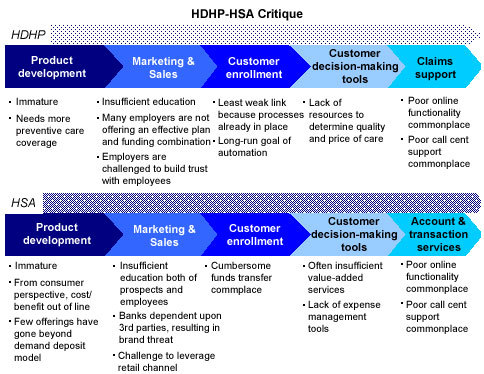

In a new report, , Celent examines the impediments to growth in both high-deductible health plans and health savings accounts. Growth has been impeded by the fact that all providers involved, including employers, have underestimated what a monumental transition the HDHP-HSA represents. They wrongly assumed that, because employees weathered the transition from defined benefit to defined contribution plans so well, they would naturally embrace self-direction in healthcare. As result, there has been inadequate pre- and post-sale education, insufficient decision-making tools, and limited employer funding of accounts. Consumers are overwhelmed by the choices and are unable to conduct an adequate cost/benefit analysis.

"The next two years will mark a period of tearing down and rebuilding at select providers and stagnancy and exiting at others. The remodelers will gain market share during the expected strong growth years of 2008 and 2009. The market will bifurcate into manufacturers and distributors," says Alenka Grealish, author of the report and Managing Director of Celent's banking group. "Because manufacturing has a relatively high fixed cost component, it will be concentrated in the hands of around 20 providers, including HSA banks and HPAs," she adds.

Despite the flat growth curve, Celent expects the market to experience growth based on 2008 enrollment and remodeling efforts. During the growth spurt, the HSA market will be up for grabs. Celent believes that over the next 24 months, the market will experience churn as consumers shop for a better offer--one not necessarily based solely on price but also on customer service and other services (e.g., expense management tools). Paramount to a successful remodel is pleasing the consumer and generating positive word of mouth. During this period, banks, which add value, will have a chance to gain higher ground.

This 38-page report contains 18 figures and five tables. It profiles the business models of the top 15 HSA providers as well as up-and-coming innovative players. A table of contents is available online.

Members of Celent's Healthcare Banking research service can download the report electronically by clicking on the icon to the left. Non-members should contact info@celent.com for more information.