How to Trade in Japan: A User's Guide to Japan's Capital Markets

Abstract

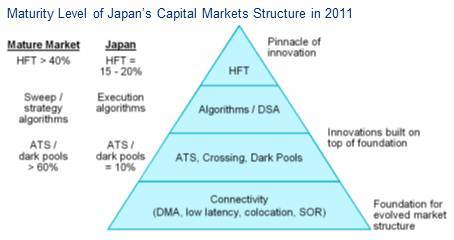

With high frequency trading (HFT) strategies nearing 20% of equities volumes, it is only a matter of time for Japan to reach the advanced execution levels that characterize a fully modern market.

Celent’s report, How To Trade In Japan: A User's Guide to Japan's Capital Markets, sponsored by NYSE Technologies, provides an overview of the state of Japan’s cash and derivatives markets, the development of advanced trading infrastructure in Japan, and the regulatory framework governing market participation by both onshore and offshore firms.

Most of the building blocks of the mature market structure that characterizes the US and Europe are already in place in Japan. Recent years have seen Japan’s exchanges introducing low latency matching engines, such as the Tokyo Stock Exchange’s arrowhead system, and the establishment of fast off-exchange venues including SBI Japannext and Chi-X Japan. Japan’s remote trading participant system, established by the Financial Instruments and Exchange Law (FIEL) of 2008, makes it possible for offshore firms to trade directly on the Japanese markets, although few firms have yet to take advantage of this access.

“Despite a tendency to conservative regulation, in many ways Japan is Asia's most advanced capital market,” says Neil Katkov, PhD, Senior Vice President, Asia for Celent and coauthor of the report. “Japan’s capital markets are evolving to an advanced market structure, characterized by low latency infrastructure, fragmentation of liquidity, and advanced execution technologies that provide the foundation for new trading strategies and opportunities.”