FRTB and the Upcoming Renaissance in Market Risk Management, Part 3: Evaluating Ecosystem Solutions

Abstract

In the years ahead, we expect that the market risk IT foundations and business capabilities built in the course of addressing and complying with the Fundamental Review of the Trading Book (FRTB) will set the stage for next-generation capabilities for market risk management.

Celent has released a new report titled FRTB and the Upcoming Renaissance in Market Risk Management, Part 3: Evaluating Ecosystem Solutions. The report was written by Cubillas Ding, a Research Director with Celent’s Securities & Investments practice.

If executed correctly, these capabilities could herald a new architectural renaissance that features business and functional capabilities built on sound data and analytical supply chains, “front-to-back-aligned” information delivery, and shareable service and process components. These operational capabilities will give banks a differentiator in determining the degree of capital impact under the coming FRTB capital regime.

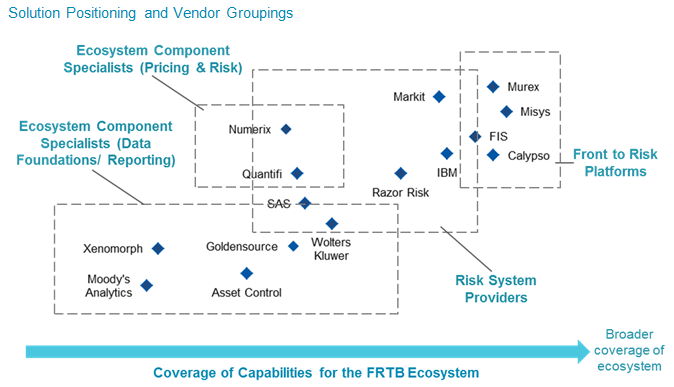

The market risk and FRTB solutions market continues to evolve as vendors enhance and launch new functionality to help financial firms operate effectively under the new upcoming regime. Beyond each vendor's traditional core competence and pedigree, we see vendor solutions falling into (occasionally spanning) several categories: Ecosystem Component Specialists, Risk Systems Providers, and Front-to-Risk Platforms.

“In forward-looking banks, the longer-term objectives and payoffs entail more than merely achieving efficiency gains, but also improving the way the bank manages risk by rethinking how the front office, risk, and finance functions embrace emerging innovations,” says Ding.

“FRTB solutions are wide-ranging in terms of functional scope and underlying IT capabilities, with a rapidly changing state ranging from brochure-ware, to proof-of-concept-ware, right to firms that have already released commercially available software. Our advice is, know thyself and know what you need,” he adds.

In this third instalment, Celent evaluates the vendors and solution offerings that address the ecosystem of requirements using Celent’s ABCD framework. This report is intended as an industry resource for firms when designing, evaluating, or making decisions on FRTB and next-generation market risk solutions.