Execution Quality in the NASDAQ Market

Abstract

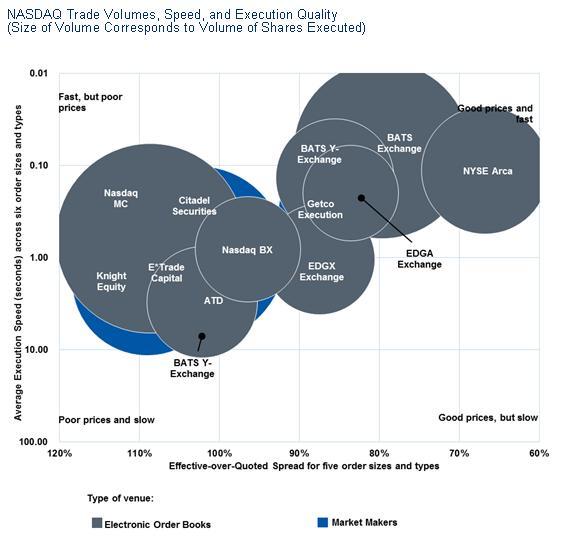

Electronic order books (EOBs) continue to dominate the NASDAQ market for the covered shares. Together, the EOBs control around 77% of the market. However, the share of market makers has gone up to 22%.

The share of the three leading EOBs (Nasdaq MC, BATS Exchange, and NYSE Arca) has recovered from 46% in the last survey to 51% in the current one. However, the three leading market makers have also improved their performance and have a combined share of 19%.

In a new report, Execution Quality in the Nasdaq Market, Celent analyzes over 16 billion orders over the period of January 1, 2012 to March 31, 2012. In total, the report by Anshuman Jaswal, senior analyst with Celent’s Securities and Investments group, measures and ranks 155 market participants according to their execution speed and prices obtained for incoming orders.

There have been some changes in terms of the top firms in Nasdaq across both average execution speed and price improvement. The leading market centers in terms of best execution currently are NYSE Arca, BATS Exchange, BATS Y-Exchange, Getco Execution, and EDGA Exchange.

Table 1 gives the overall rankings for the leading venues of the NASDAQ issues. The best performers in the price rankings among the top market centers are Wells Fargo Securities, Liquidnet, LeveL ATS, and NYSE Arca. In terms of execution speed, Wells Fargo Securities, two BATS exchanges and NYSE Arca were the top performers.

Table 1: Overall Ranking of Market Centers | ||||||||||||||||||||||||||||||||||||||||

Price Ranking |

Market Center |

Speed Ranking |

Market Center |

|||||||||||||||||||||||||||||||||||||

1 |

Wells Fargo Securities |

1 |

Wells Fargo Securities |

|||||||||||||||||||||||||||||||||||||

2 |

Liquidnet |

2 |

BATS Y-Exchange |

|||||||||||||||||||||||||||||||||||||

3 |

LeveL ATS |

3 |

BATS Exchange |

|||||||||||||||||||||||||||||||||||||

4 |

NYSE Arca |

4 |

NYSE Arca |

|||||||||||||||||||||||||||||||||||||

5 |

BofA Merrill Lynch |

5 |

D.A. Davidson |

|||||||||||||||||||||||||||||||||||||

|

Table 2 shows the rankings for the major electronic order books (EOBs). Comparing the major electronic order books for price improvement, we find that the best EOBs are NYSE Arca, EDGA Exchange, Nasdaq BX, and the two BATS exchanges. For average speed of execution, the leading EOBs are the two BATS exchanges, NYSE Arca and EDGX and EDGA Exchanges. Across the two best execution parameters, the leading EOBs are NYSE Arca and the two BATS exchanges.

| ||||||||||||||||||||||||||||||||||||||||

Wells Fargo Securities, Knight Capital, and Citadel Securities are the best market makers when we compare price execution. Similarly, Wells Fargo Securities, Citadel Securities, and Knight Capital are the best performers when we compare average execution speeds. Overall, Wells Fargo Securities, Knight Capital, and Citadel Securities are the leading market makers on the two best execution parameters.

Table 3: Ranking the Major Market Makers | ||||

Price Ranking |

Major Market Makers |

Speed Ranking |

Major Market Makers |

|

1 |

Wells Fargo Securities |

1 |

Wells Fargo Securities |

|

2 |

Knight Capital |

2 |

Citadel Securities |

|

3 |

Citadel Securities |

3 |

Knight Capital |

|

4 |

UBS Securities |

4 |

E*Trade Capital |

|

5 |

ATD |

5 |

Knight Equity |

|