Capital Market Trends in Japan, Part 1: Birth of a New Exchange

Abstract

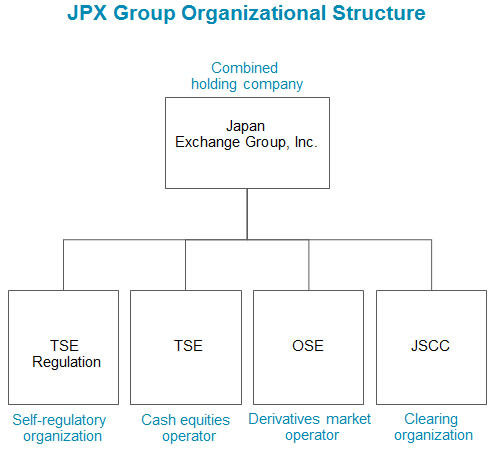

After years of exchange consolidation in the US, Europe and elsewhere in Asia, Japan is finally seeing a major merger of its capital markets exchanges. How will exchange consolidation impact Japan’s capital markets?

In this report, Capital Market Trends in Japan, Part 1: The Birth of a New Exchange, Celent examines Japan’s market in the context of the dramatic changes in Europe and North America.

Source: TSE, Celent

“Japan’s capital market has yet to experience a big bang structural reform such as those seen in Europe and North America. Nor has Japan experienced a tidal wave of technological innovation. Furthermore, the integration of Japan’s exchanges has differed from the mergers that took place in in Europe and North America,” says Eiichiro Yanagawa, author of this report and a Senior Analyst in the Asian Financial Services group at Celent.

In its review of the merger to create the Japan Exchange Group, the Japan Fair Trade Commission laid out three conditions for approval:

- Involving outside experts in determining fees.

- Ensuring the continued existence of proprietary trading systems.

- Securing internationally licensed operators in derivative-related businesses.

“These three points were taken up to ensure diversity and competitiveness on the coming global exchange,” Yanagawa adds.

This report, the first of two, reviews the changing environment of the world’s securities exchanges, business opportunities, and strategic choices. It delves into the history and current state of Tokyo Stock Exchange’s arrowhead initiative, and concludes with a recap of events leading to the upcoming Japan Exchange Group merger.

Part 2 discusses best execution-related system innovation and changes in market structure, as well as the current state of trading technology innovation, before addressing these in terms of Japan’s market.

This 30-page report has 6 figures and 11 tables.