Blockchains and Digital Currency Wars: Implications of Counterparty Risk-Free Digital Assets for Capital Allocation

Abstract

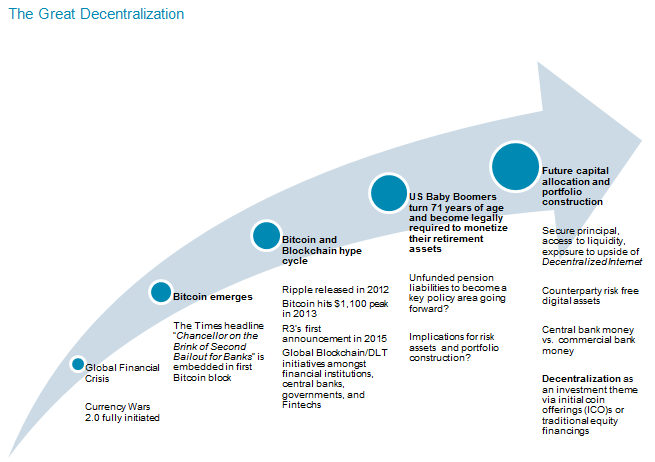

This is the third in a series of three research reports investigating the impact of Blockchain / Distributed Ledger Technology upon movements of value and the capital markets.

Celent has released a new report titled Blockchains and Digital Currency Wars. The report was written by John Dwyer, a Senior Analyst with Celent's Securities & Investments practice.

We are witnessing extraordinary innovation impacting means for transferring value. This is creating a new digital asset class which can be moved on a peer-to-peer basis, with optimized settlement-cycles, thus reducing or even eliminating counterparty risk.

The next wave of digital assets could finance the architecture of a new decentralized Internet and, for those investments that are successful, are likely to generate financial returns which are unparalleled in nature.

Titled assets can be moved on a P2P basis with optimized settlement cycles and settlement finality.

These include permissionless cryptocurrencies, permissioned cryptocurrencies, and precious metals integrated on a Blockchain/DLT. Baby boomers turn 71 this year and will be legally required to begin taking Required Minimum Distributions from their retirement assets.

The impact on volatility, liquidity, and overall capital allocation as baby boomers monetize their retirement assets will be a key period for the capital markets to digest.

This is coinciding with the emergence of a new digital asset class which can offer extraordinary upside. Financial institutions need to think very carefully and creatively about how they tailor their digital strategies to address these key trends.

“The extraordinary price action of cryptocurrencies cannot be ignored. These remain high-risk assets given the issues around Proof of Work, 51% attacks, and privacy, among other issues. However, a combination of asset, monetary policy, and technology trends are converging which are redefining the global financial system. The Enterprise Ethereum Alliance is one very good example of how enterprises are actively engaging with this ecosystem,” Dwyer commented.

“We are in the early stages of a new wave of digital assets which have the potential to create, transfer, and even destroy enormous amounts of wealth. The theme of Decentralization is going mainstream, and its impact is going to be profound,” he added.