Branch Transformation Panel Series Part 6

Abstract

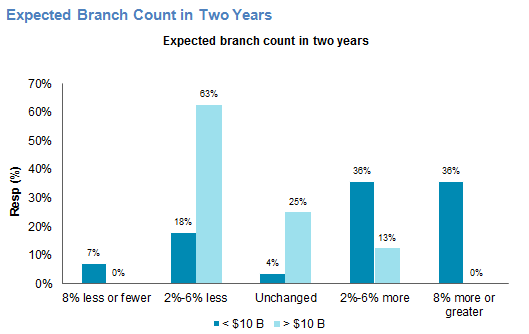

Branch count will go down in the next two years, but large banks will cut branches while small banks add branches.

Celent has released a new report titled Anatomy of Branch Transformation in the Short Term: Branch Transformation Panel Series Part 6. The report was written by Bob Meara, a Senior Analyst with Celent’s Banking practice.

Overall, there will be fewer bank branches in two years, but only large banks will cut branches. Over half of surveyed banks and credit unions plan to increase their branch count in the next two years.

Larger banks will lead in pruning their networks, while smaller institutions will operate larger networks as they seek growth through footprint expansion. Utilizing branch resources to maximize digital channel enrollment is now every bit as important to surveyed institutions as sales and service effectiveness. Institutions broadly understand the importance of digital, regard digitally driven customers as generally more profitable and loyal, and apply branch resources to increase digital adoption and utilization as a result.

“Banks say customer relationships are their #1 strategic priority, but you wouldn’t get that impression based on what aspects of the branch customer experience are measured (or not measured),” commented Meara.

“For example, less than a third of surveyed institutions (mostly large banks) measure customer wait times or branch employee utilization. Barely two-thirds measure branch channel utilization among customers,” he added.