Alternative Realities: The Commoditization and Allure of Alternative Payments

Abstract

In the past three years, alternative payments have gained considerable market value with no loss of momentum in sight. Alternative payments currently account for roughly 15% of total e-commerce volume. However, by offering a superior value proposition to buyers, alternative payments pose a threat to traditional payment methods. PayPal's recent acquisition of Bill Me Later validates Celent's assessment that the strongest value is derived from the creation of sales lift.

In less than a decade, alternative payments have evolved from "dot bomb" burnouts to widely accepted, widely recognized forms of online payment. Alternative players' business models once relied on their solutions' status as "something new" or the only way to pay in a particular online environment. However, they now focus on providing greater value than payment cards. Card brands and issuers stand to forgo $345 million in volume in 2010 and about $1.7 billion in volume in 2015 to alternative payment. In a new report, , Celent examines the maturation of the online alternative payments sector.

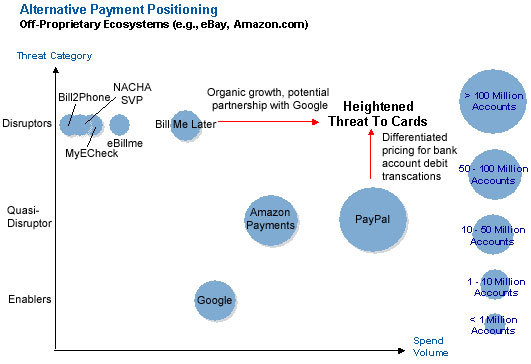

Given cards' historical dominance over online payments, this market is the card industry's to lose. Every time a bank account is debited via ACH rather than a card, the card industry loses roughly 1.5 - 2.4% or more of the transaction size. The card industry must pay attention to alternative payments, which can be categorized as enablers, quasi-disruptors, or disruptors, in order to prevent further losses.

However, the outlook is not entirely rosy for alternative payments. "Alternative payments players have already become commodities in terms of security, convenience and pricing. The real differentiator is their ability to induce purchases and affect a corresponding sales lift. Of all the major alternative payments players, Bill Me Later understands this the best," says Red Gillen, senior analyst with Celent's banking group and author of the report. "The greatest threat to the card industry is a disruptive alternative payments solution that has figured out how to increase online merchants' sales. With its recent acquisition of Bill Me Later, PayPal is obviously a believer in this fact."

"The spoils will go to those players who understand that their role is no longer simply making shoppers able to pay. Instead, such players realize that, going forward, they must make shoppers want to pay," he adds.

This report spotlights some of the main players in the remittance space and provides an analysis of how they match up against online payment incumbents (cards) as well as each other.

The report contains 56 pages, 17 figures and 10 tables. A table of contents is available online.

of Celent's Retail and Business Banking research service can download the report electronically by clicking on the icon to the left. Non-members should contact info@celent.com for more information.