Got Data? Gauging US Consumer Willingness to Use Smart Technology and Share Private Data

Abstract

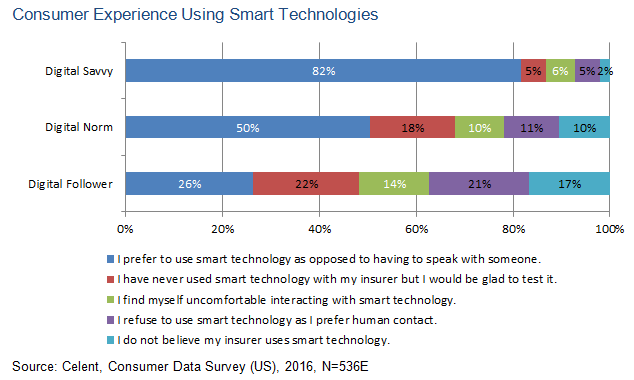

US consumers want more mature smart technologies that can deliver lower costs, faster services, and more personalization. If insurers want consumers to share their data, they should know consumers want something for it.

Celent has released a new report titled Got Data? Gauging US Consumer Willingness to Use Smart Technology and Share Private Data. The report was written by Mohammed Mahfuz, an Analyst in Celent’s Insurance practice.

Insurers may be trying to implement the latest trends in smart technologies, but in order to do so successfully they should know the impact these tools will have. Emerging technologies such as robo advisors, chat bots, and artificial intelligence can change the traditional insurance model and have the potential to generate value in a variety of ways.

Consumers do not want to waste their time when looking for information and require instant understanding of the interaction interface offered by insurers.

The biggest reason to share data is to obtain a premium discount. Consumers have a high appetite and curiosity for bots and robo advice, and insurers should grasp the opportunity to investigate how they can invest in these technologies to generate higher value in customer interactions.

“As people start to move toward mediums that are inherently digital and away from human touch mediums (landline phones, in-person), insurers will have to enhance their digital solutions,” says Mahfuz.

“Even if consumers are willing to share their data by authorizing its use, that doesn’t mean it will come for free. They will only provide data if they are given incentives to do so,” he adds.