It is early days for generative AI (GenAI) adoption across capital markets. And even earlier days for agentic AI adoption. Celent anticipates the current wave of GenAI adoption by financial institutions (Fis) will remain focused on advancing intelligent virtual assistants (IVAs) that respond to queries and requests from employees and customers, although code development and content summarization/generation are also strong use cases for capital markets entities. Celent believes that agent chaining (combining specialized agents to support a workflow or customer journey) will have profound impact in numerous areas of capital markets, supercharging STP and impacting numerous lines of business.

But it is not too early to monitor agentic AI trends and ideate use cases. Celent recommends that financial institutions develop their AI/GenAI strategy with the anticipation that agentic AI-supported workflows will become a viable option in the next five years. They should ideate internally and engage with third-party providers of agentic AI solutions, monitoring their progress and that of early adopter banks.

To assist our clients to grasp the meaning and implications of agentic AI in financial services, Celent has compiled a series of flash reports taking different points-of-view across financial services verticals. The reports go from the 10,000-foot level (definition) to ground level (examples and tech providers), and highlight examples of prominent financial institution’s adoption approach. This report looks through the lens of a capital markets financial institution.

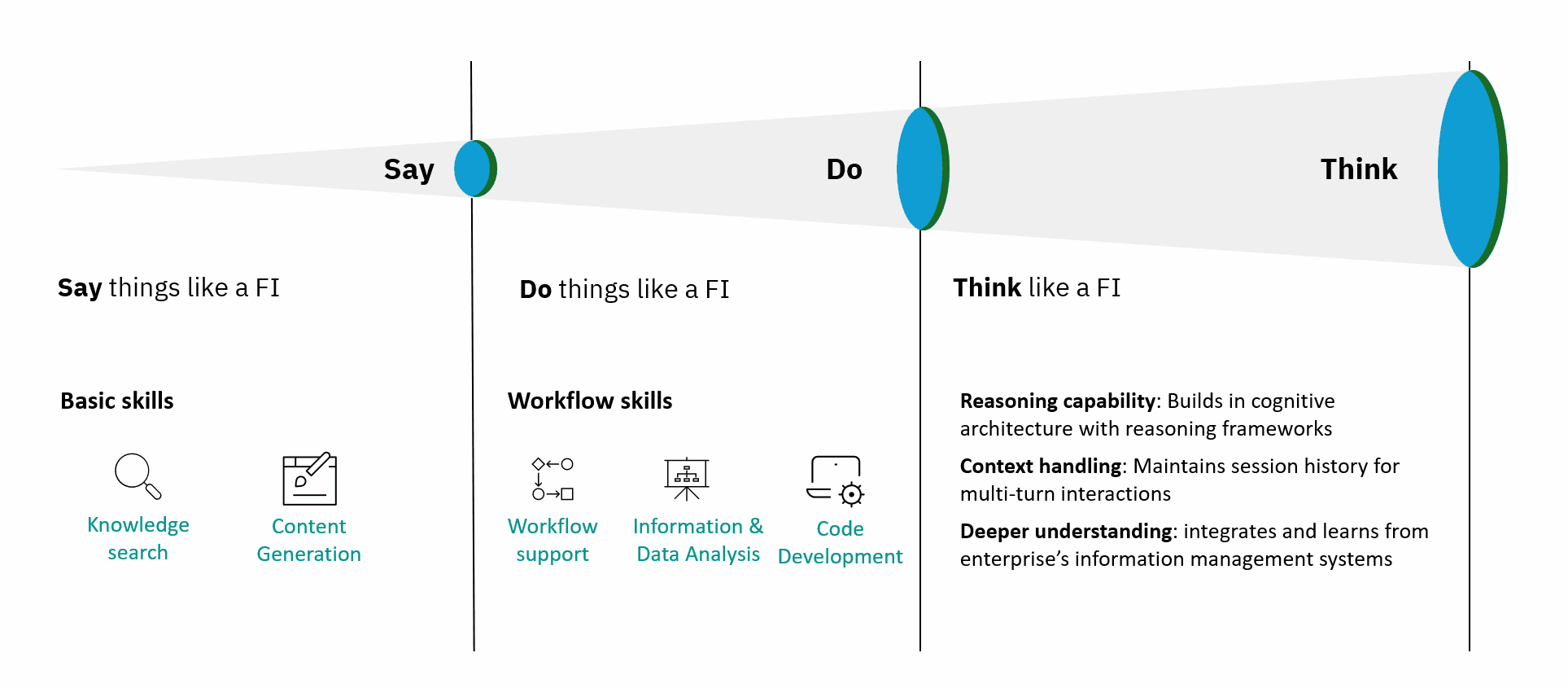

Figure: The Agentic AI Revolution: from Say to Do and Think for a Financial Institution (FI)

Companies mentioned in this report include: AWS, Google, IBM, Oracle, and Microsoft; Anthropic, Cohere, Meta, and OpenAI; crewai, Hugging Face, and LangChain; Glean, Inflection AI, and Relevance AI; Salesforce, ServiceNow, Nvidia, and UiPath; Goldman Sachs, Blackrock.