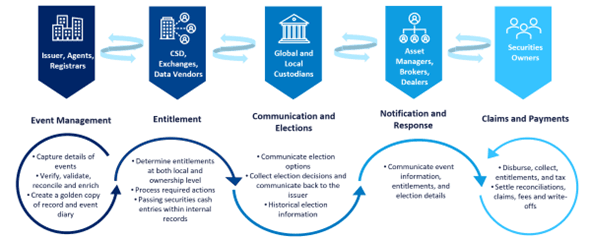

Corporate actions impact securities owners’ portfolio positions and risk; but the complexity of processing these correctly and efficiently at the institutional level requires numerous intermediaries in the value chain. These intermediaries include the issuers and their agents, exchanges and depositories, data vendors, custodians, asset managers, and broker-dealers. The process requires coordination among these entities and involves executing several functions. Solutions providers focused on this area offer a range of services aimed at one or more entities along the chain.

In this report Celent researched the industry challenges within the landscape of corporate actions processing and spoke to leading solution providers to better understand how advanced technology is being leveraged to solve these challenges.

The solution provider landscape around corporate actions comprise a diverse mix of data vendors, data management solutions and service providers, market infrastructure players, custodians, and technology and service providers. The next instalment in this series on corporate actions will be a report covering the landscape of solutions providers including a comparison of their offerings.

Celent identified the following key trends and industry challenges hindering automation of corporate actions processing.