Celent held its digital 2021 Innovation and Insight Week from March 9 – 11, 2021. The theme we explored this year was "Accelerate!” Many of our winners completed initiatives in weeks or months, that might otherwise have taken them quarters or years. Innovation in banking didn’t slow during the pandemic, it accelerated! For a recap of Celent Innovation & Insight Week 2021, see Jamie Macgregor’s succinct and insightful comments at: https://www.celent.com/insights/246616807.

Although the case studies are in a variety of technology categories, all Model Bank winners had one thing in common: they excelled at making significant improvements at improving customer engagement and the experience. The opening plenary session included comments from Pete Kenning of CedarCX, who provided a succinct overview of how customer communications management (CCM) and customer experience (CX) platforms enable B2B and B2C omnichannel communications. In this blog we provide a brief summary of banking industry forces that are leading financial institutions (FIs) to take a multi-channel, enterprise approach to managing and automating the customer experience using CCM and related systems. We then recap five key tips from CedarCX’s I&I Day plenary session remarks.

Overview

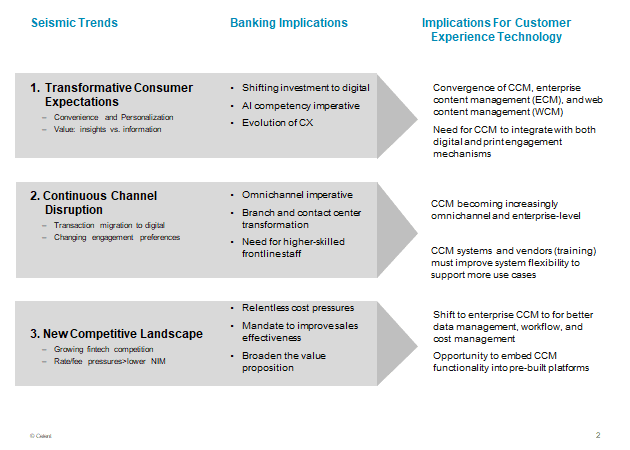

Figure 1 illustrates three seismic trends shaping many aspects of the retail banking business and technology requirements. We mentioned changing consumer expectations driven by digital mentioned above; there are two others: changing channel utilization and a changing competitive landscape driven by fintech initiatives. These trends have implications for both financial institutions and CCM vendors.

Figure 1: Three Seismic Trends Have Implications for Customer Experience

Source: Celent analysis

CCM vendors must improve their systems’ flexibility to support more use cases. CCM solutions that excel at customer service and print communications need to better integrate with digital engagement mechanisms in the banking product shopping, origination, and onboarding processes. In addition, enterprise CCM and omnichannel CCM are becoming increasingly important. Therefore, CCM systems need to become more omnichannel and enterprise-level in their integration capabilities and functionality. Third, CCM, enterprise content management (ECM), and web content management (WCM) functionality is increasingly overlapping. Finally, FIs will increasingly expect CCM functionality to become more componentized so parts of it can be added to pre-built platforms.

Here are CedarCX’s practical execution strategies and tips for accelerating digital transformation and modernizing your customer experience:

Service events (customer journeys) are:

· as every day as bill to pay,

· as complex as managing a debit or credit card dispute,

· and as rare as closing the account of a deceased person in New Jersey or Florida

Exception processes and “orphan” events rarely get automated, and that is the problem.

Celent opinion: All service events matter.Most financial institutions have automated the easier, single channel, and scalable customer journeys. This is table stakes. It is the harder, multichannel customer journeys and exception processes that are most costly, slow down operations, leave customers most dissatisfied, and often cause customers to leave. To succeed in the future, FIs need to focus on transactional cost, not on transactional scale. This new calculus must be included in the ROI calculation to reveal the benefits of automating more customer journeys, and in selecting the vendor that can automate at the service event level.

· What Happens When the bill doesn't get paid? what kicks off automatically to support the next step of that customer journey?

· What Happens When an email bounces or the mail is going to be returned? What kicks off to automate the remediation (exception process) of that activity?

The number of examples go on and on, but answers to “What Happens When?” when documented will ensure the operational automation of every service event.

Celent opinion: What happens is that too many live humans begin tedious processes that take too long and upset the customers. These processes are a drain on operating costs and keep the expense ratio high. Financial institutions need to reexamine these exception processes created to accommodate legacy customer engagement technology and utilize flexible rules-based systems with open integration protocols to automate human-based processes out of existence.

The data model and workflow engine is what connects your source systems (the service event trigger points) to the component technologies required to manage omnichannel communication outputs, includes digital content; composition and delivery; reporting, tracking and remediation; archival and more. Get the data and workflow right or continue to struggle.

Celent opinion: data management and workflow go hand in hand. The workflow engine needs to know what each data element means in the right context, know which channel to send it through, and be able to efficiently automate a large number of customer journeys with less development and maintenance time and cost. The technology also needs to be modern enough to respond to all service events in real time.

Connect your source systems to your customers on a single customer communications management CCM platform and leverage it as an enterprise shared services offering that includes APIs for real-time communications.

Celent opinion: Ask for your IT department’s IT inventory documents and you’ll see how complex your infrastructure is. Fortunately, web services, componentization, APIs, mobile, and cloud have permanently altered how technology is built and managed. The requirements of openness and componentization has also blurred the lines of distinction between yesterday’s IT product category definitions and tomorrow’s solutions that cross over yesterday’s channel and IT product boundaries. This will enable you automate while keeping some systems and consolidating others. The benefit? You’ll be able to create a multichannel, cross-product, and cross-line of business, “mass customization” of every customer service experience.

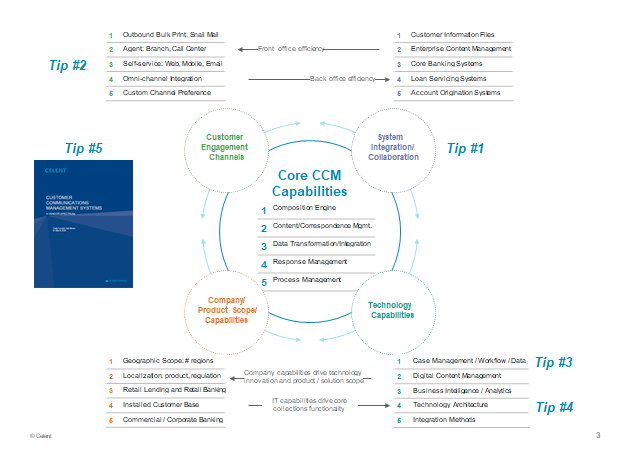

Celent’s ABCD and Vendor Spectrum reports provide financial institutions with benchmarks for technology differentiation across vendors. Figure 2 provides a sneak preview; it summarizes the vendor assessment approach from Customer Communications Management: A Vendor Spectrum.

Figure 2: Capabilities of Enterprise, Multichannel Customer Experience Systems

Source: Celent

Path Forward

What Happens When? is the question every CEO, Head of Retail, and staffer responsible for digital and non-digital customer journeys needs to ask.

For more information on this topic across financial services, see the related research listed below.

Related Research

Customer Communications Management Systems 2020: A Vendor Spectrum

March 2020

Customer Communications Management in a Digital World

March 2020

Optimizing the Consumer Credit Lifecycle

November 2019

Breakdown to Breakthrough: Energizing Your Customer Communications Management

October 2019

Customer Communications Dynamics in Insurance: Deals, Functionality and Technology

January 2018

Customer Communications Management in Insurance: ABCD Vendor View

January 2018