新型コロナウイルスのパンデミックが市場を揺るがし、金融サービスのほぼ全ての分野に影響を及ぼすなか、不動産弁護士、投資アドバイザー、フィナンシャルプランナー、会計士は、自らの死について常に意識せざるを得ない状況にある顧客からの相談に追われている。様々な財産管理者の立場を整理するという煩雑な手続きに続いて、遺産を構成する多くの要素の相続計画の策定が必要になる。関与する全ての当事者に等しく情報が行き渡るようにするには膨大な手間と時間のかかる手続きが必要になる。人生の経過とともに遺産は増えたり変更が加えられたりするため、当事者である個人と受取人を更新する過程では、長期間にわたって記録されない変更事項が蓄積することになりかねない。

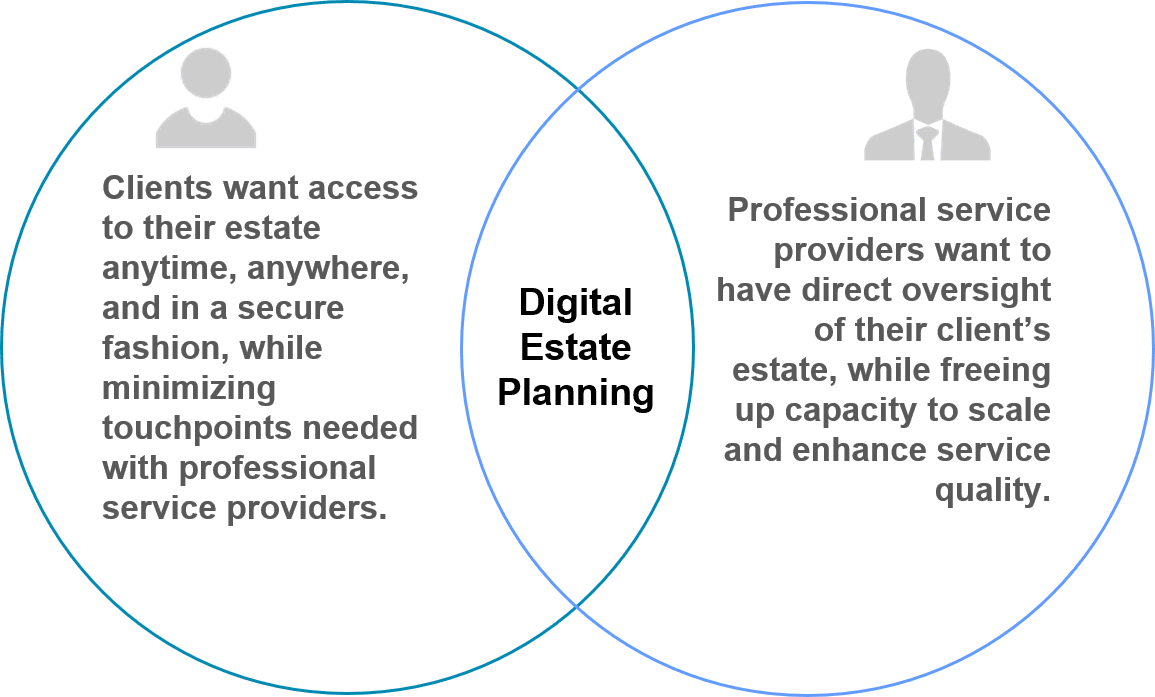

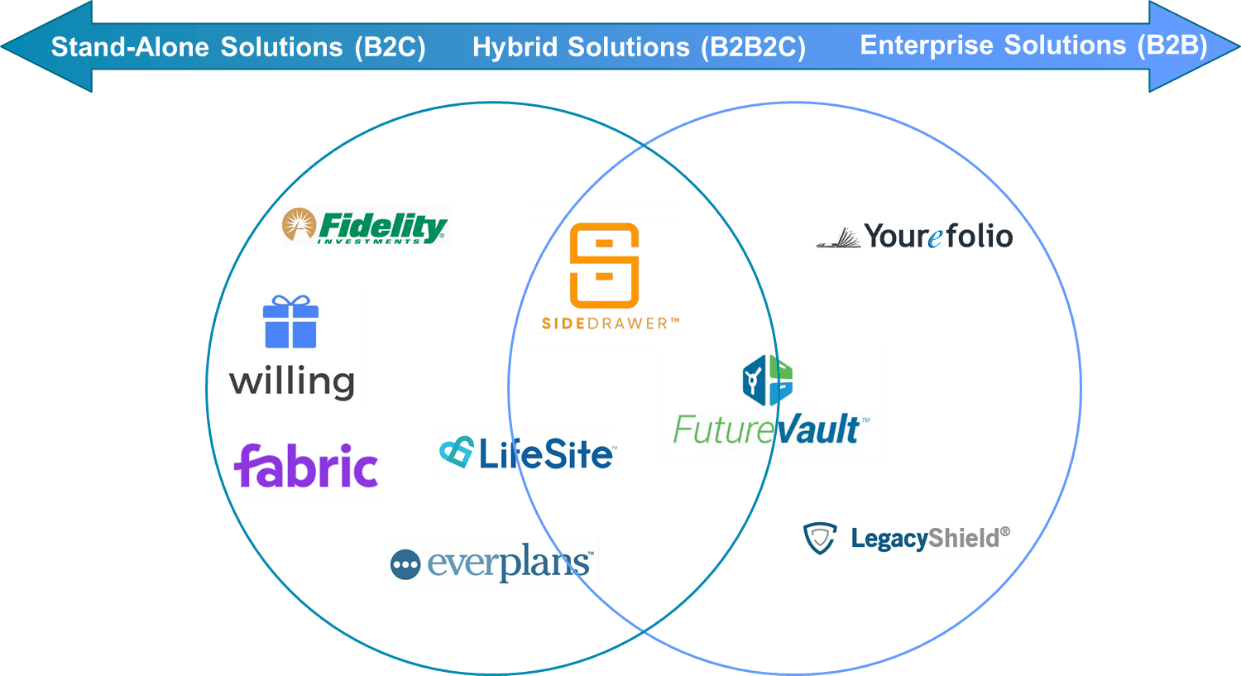

遺産相続計画は複雑で機密性の高いテーマでもあるため、顧客は対面でのやり取りや局面に応じたアドバイスを好む傾向があり、デジタル化は進んでこなかった。だがソーシャルディスタンスの確保が求められるコロナ危機下では、対面でのやり取りはほとんど不可能となり、デジタルによる遺産相続計画ツールが不可欠となった。本レポートは、財産管理者と顧客の橋渡し役を担うセルフサービスのデジタル遺産相続計画ソリューションを提供するベンダーを取り上げている。

(詳しい情報は、セレント北川俊来TKitagawa@celent.comまでお問合せください)