The foreign exchange (FX) and trading technologies industry is experiencing significant transformation driven by increased electronification and automation. This evolution is necessitated by the growth in exchange-traded volumes and the expansion of alternative trading venues. The demand for advanced execution tools, price distribution mechanisms, and trading algorithms is on the rise. Additionally, the industry is seeing a growing need for quality data and analytics capabilities, including machine learning (ML) and artificial intelligence (AI) technologies. Efficiency in workflows, end-to-end trade lifecycle automation, and post-trade streamlining remain critical demands from market participants.

The FX trading industry faced significant challenges during the pandemic period, revealing structural and technical issues. The increased trading volume, volatility, and profits experienced by participants exposed weaknesses in various offerings and internal workflows. As a result, there has been a growing demand for trade lifecycle automation across all market participants.

The market is now looking for broader data to support advanced analytics as more market players are looking to offer advanced algo execution services to institutional and corporate clients.

This report provides a concise overview of significant developments in the FX market, with a particular emphasis on trading and execution and their impact on technology decisions. It examines the current state of the FX market and highlights emerging technology trends, offering insights into the future direction of the market.

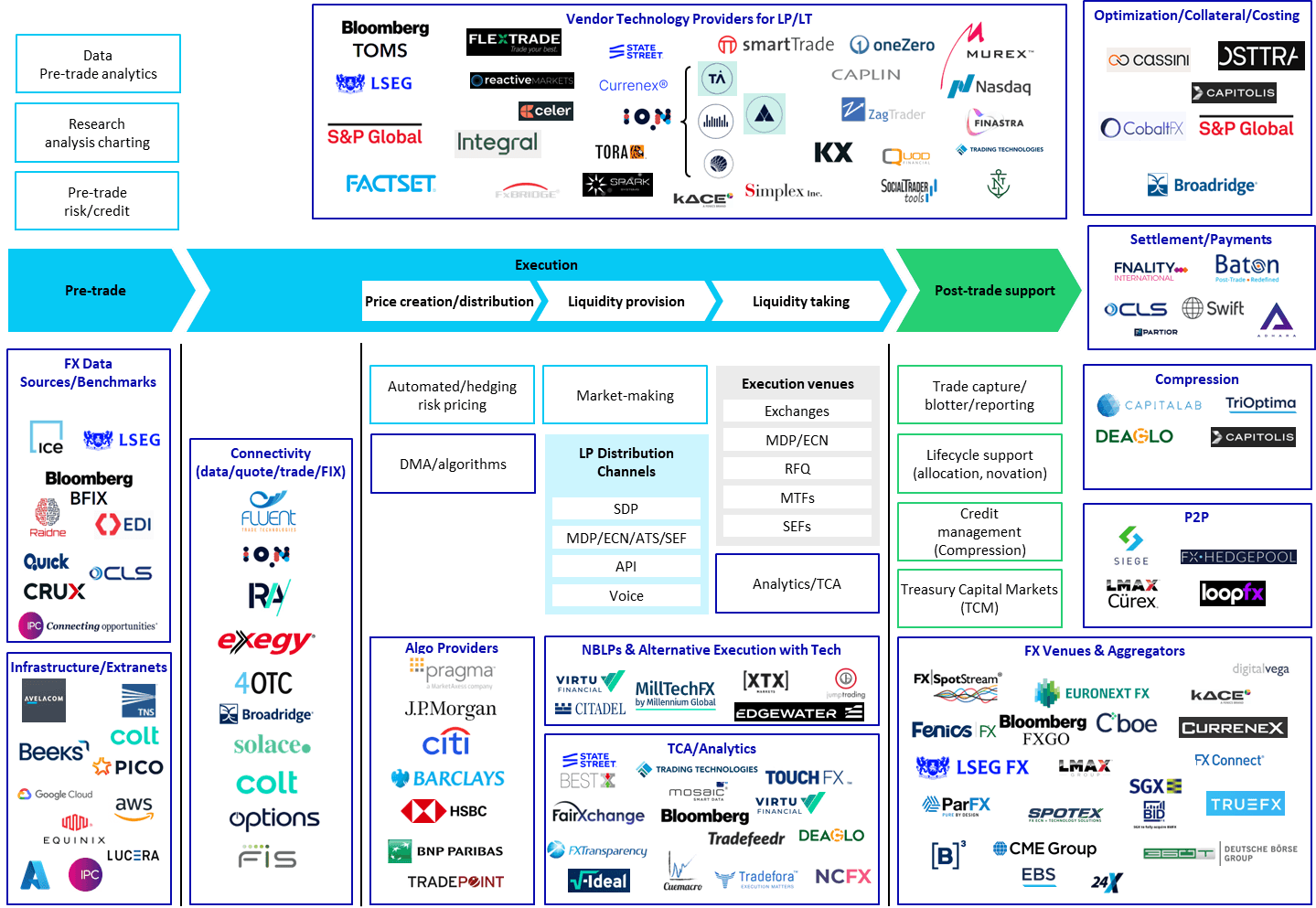

The FX technology solution and venue ecosystem is a mixture of financial technology firms and trading venues with multiple models of FX execution, venue, and aggregators, and specialty fintech