Secular themes are currently playing out throughout the investment sector around alpha generation, cost takeouts and the ongoing digitization of the investment value chain. Apart from nearer-term trends (such as regulation, pricing / fee pressures, impact investing), incumbent buy side firms expect technology and digitization themes to be the most disruptive in the longer-run.

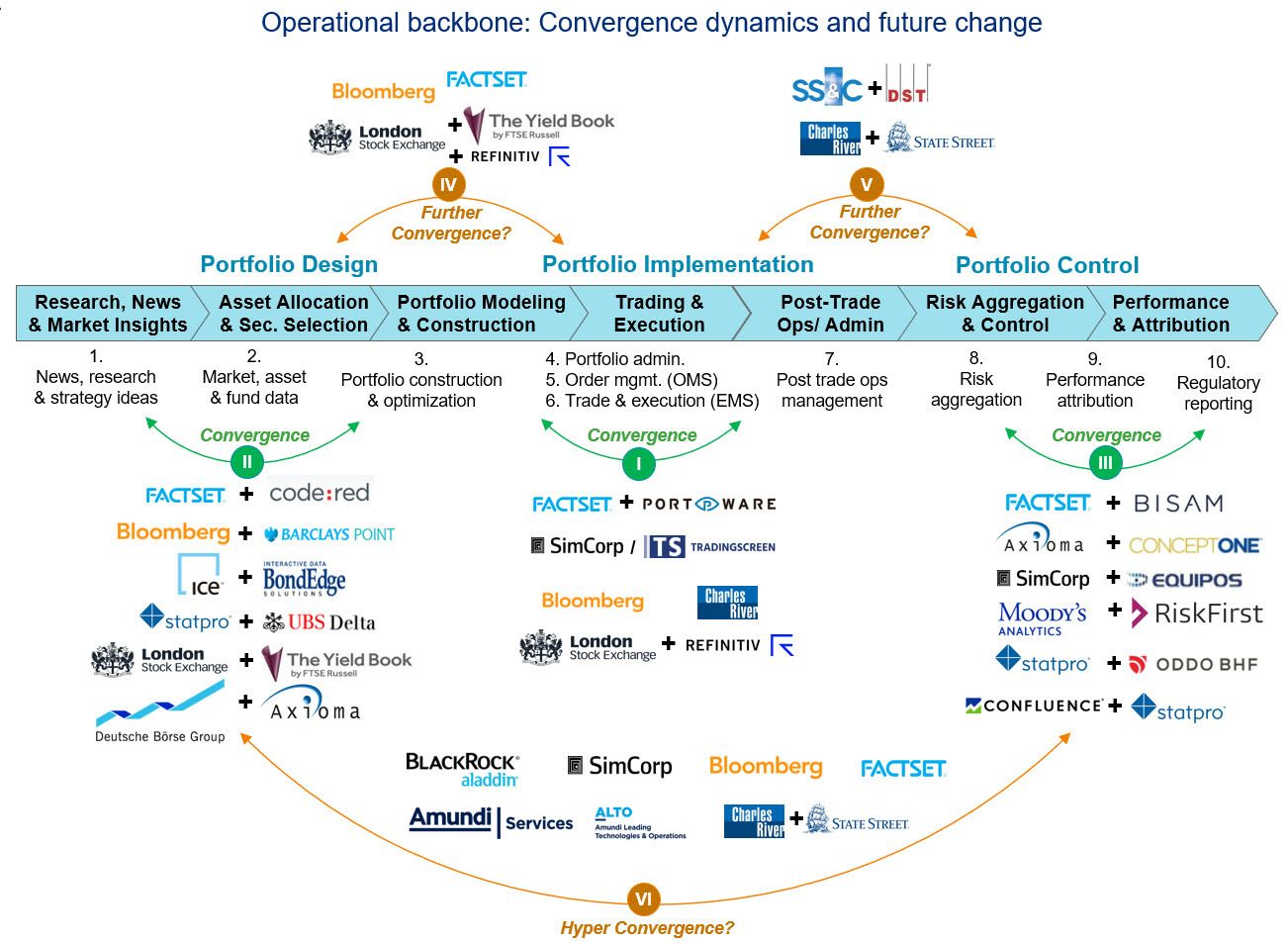

Convergence dynamics at investment businesses and solution providers are already a reality – but the real questions are:

- To what degree will convergence continue, and in what form?

- Will end-to-end solution paradigms win over 'best of breed' approaches?

- How, and where will digitization effects play out?

In this study, Celent presents long-term 'crystal ball' perspectives on the future terrain of the investment technology landscape, what investment firm can expect from competition dynamics between solution providers, and how movers and shakers could evolve to shape the 'operational backbone' of the industry in the coming decade towards 2030.