Global treasury management surveys confirm Celent research showing managing cash and liquidity is still the top priority for treasurers worldwide. This season, conference sessions featuring liquidity management were packed, as companies seek to optimize free cashflow, but also seek higher yield on balances.

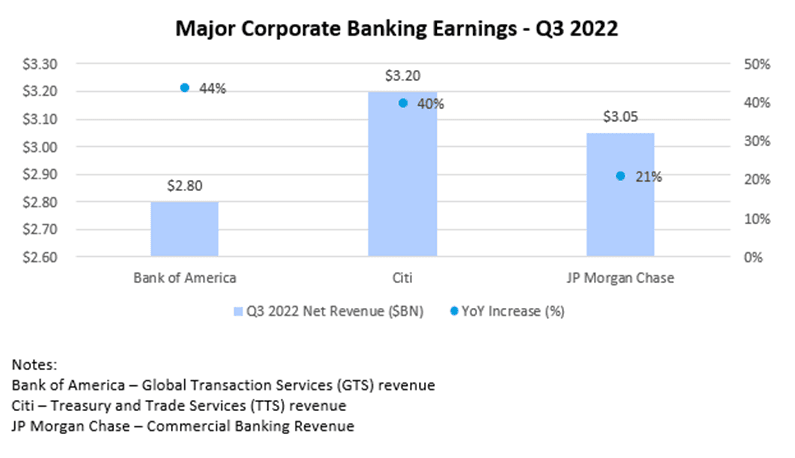

Deposits are critical for banks too, as are the rates paid. Net interest income from commercial loan balances and non-interest income from fee-based core transaction banking products and services drive cash management revenue growth across the board for banks. Despite the turmoil in the markets throughout 2022, transaction banking revenues of major banks significantly increased year over year, with cash management revenues increasing for the first time in three years.[1] In addition, interest rate increases have improved net interest income, and fee-based income has also risen as payments and receivables volumes remain strong. Figure 1 shows commercial and/or transaction banking revenues from three of the top global transaction banks.

Figure 1: Growth in Global Banking Revenues

Source: Bank quarterly earnings presentations and Celent analysis

Third quarter earnings from Bank of America’s Global Banking business showed revenue from Global Transaction Services up 44% YoY, although global banking deposit balances fell 7%.[2] At JP Morgan Chase, commercial banking revenue rose $528MM YoY, or an increase of 21%.[3] Additionally, JP Morgan’s CIB Payments revenue alone was $2BN, a gain of 22%, due to fee growth. At Citi, the growth was driven by a 61% increase in net interest income and 8% growth in fee income.[4]

If there’s a dichotomy in the profitability of cash management services from banks and the cash management needs of treasurers, it is this. Treasuries are seeking to bolster their balance sheets and maximize yield on deposits (and investments) as economic storms loom. Banks, that have pricing power, have been able to increase NII and NIM as interest rates rise. However, 2023 is upon us and treasuries want relief. More than one corporate treasury has bemoaned the fact that interest rates on their deposits remain many points below the cost of borrowing.

What’s the role of technology in this? Banks will look to balance the demand to pay higher rates with their preservation of NII and NIM. This is a key area where leading banks will use advanced analytics to optimize balances held and rates paid. In other words, what rate can attract deposits from clients vs what balances may be lost due to attrition where a client’s rate remains low. It is a narrow path to walk. Marry that to a risk profile of industries and companies at different stages of the economic cycle, and the models start to become quite interesting!

Ultimately there are many factors that impact transaction banking revenue. However, the ability for banks to successfully apply data science models to complex price and rate variables will impact the next rounds of quarterly results, and their clients’ balance sheets.

[1]Coalition Index for Transaction Banking – 1H22, Coalition Greenwich September 2022

[2]Bank of America 3Q2022 Financial Results, October 2022

[3]JP Morgan Chase & Co Third Quarter 2022 Results, October 2022

[4]Citi Third Quarter 2022 Results and Key Metrics, October 2022