As banks look to improve the corporate banking customer experience, by upgrading their technology infrastructure, they often turn to digital corporate banking suites to upgrade their technology infrastructure.

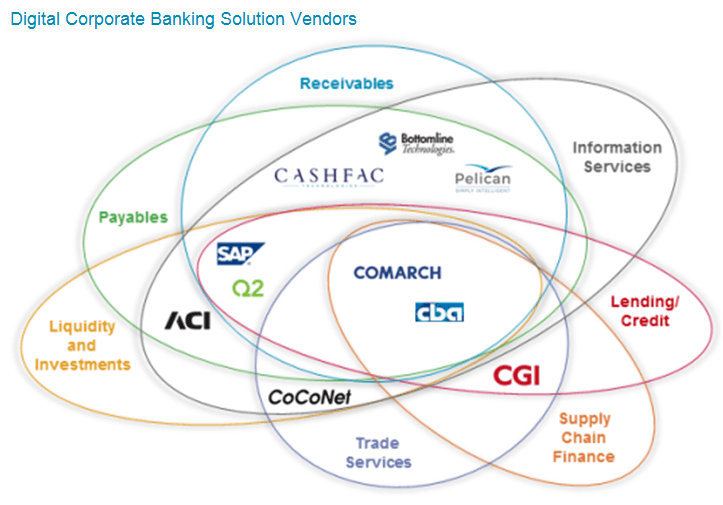

For banks to capture a greater share of the global corporate banking wallet, they must consistently invest in updating and enhancing their corporate banking solutions to meet client demands for ease of use, flexibility, and convenience. Banks often turn to packaged software to round out their product set. Providers vary in geographic reach, installed customer base, and integration approach. Celent profiles solutions from 10 vendors.

For banks able to deliver comprehensive, tailored, and connected corporate banking products, the rewards can be substantial. However, banks looking to capture a greater share of the global corporate banking wallet must consistently invest in updating and enhancing their corporate banking solutions to meet client demands for ease of use, flexibility, and convenience. As they look to invest, banks often turn to packaged software to round out their product set.

In mid-2017, Celent kicked off a research effort to understand the opportunity across corporate banking. The first report in this research series, Connected Corporate Banking: Breaking Down the Silos, looked at corporate banking performance, segment revenue, customer segmentation, technology drivers, and software providers. As part of the research project, Celent issued an RFI to vendors offering corporate banking technology across product segments. Based on the RFI responses, Celent separated the vendor solutions into two primary categories: 1) integrated corporate banking suites and 2) digital corporate banking solutions.