Global trade has been a driving force behind human civilization, fostering connections between cultures and regions through commerce. Banks play a crucial role in the trade and supply chain finance ecosystem, working closely with corporate clients to deliver customized solutions. However, the burden of manual processes has weighed them down, inundating them with paperwork and documents, resulting in inefficiency and costly errors.

Open account transactions offer flexibility and simplicity, eliminating the need for complex documentation and financial intermediaries. However, they also come with risks, such as nonpayment or delayed payment, which the parties involved must carefully manage and mitigate. Bank of America, a global leader in transaction banking, has been offering open account processing to a select number of clients for strategic reasons. Based on its internal estimates, the bank receives approximately 4 million pieces of paper at its counters yearly to facilitate this process for its open account product customers. Attempts by the industry to digitize the solution have been mainly unsuccessful to date, primarily due to the varying levels of digital adoption across participants of the supply chain and technology cost.

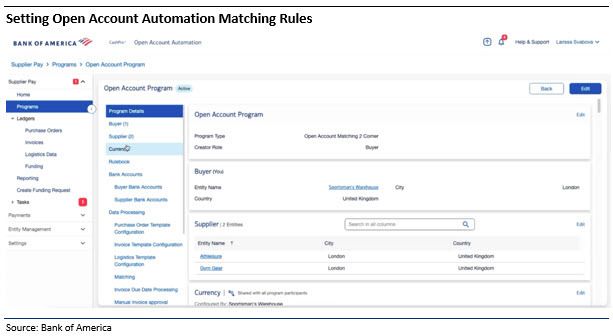

Bank of America has reimagined trade and supply chain finance for its business clients with its Open Account Automation solution. Open Account Automation is a faster, simpler way for clients to manage their open account trade activities. Powered by an advanced processing platform that captures and digitizes data from documents, it also facilitates near real-time matching and exchange of information between parties using distributed ledger and cloud technology.

The solution minimizes manual processes and reduces match and approval time from weeks to minutes – and the ability to unlock procure-to-pay benefits.