Each year, Oliver Wyman (our parent company) partners with Morgan Stanley Research to publish an industry outlook for Wholesale Banking. This year’s report is titled “Into the Great Unknown” and focused on two forces driving Wholesale Banks to adapt in the next cycle: 1) the end of lower for longer rates, and 2) potentially diverging Basel 3 capital standards between the US and other jurisdictions, benefitting non-banks and banks outside the US. Our framework assesses the wide range of potential outcomes.

The wholesale banking industry[1] has spent the years since the Global Financial Crisis (GFC) reshaping its business model to increase resilience and generate sustainable returns. The transformation has been profound, but the industry must now respond to new and significant shifts in the operating environment. The authors expect these changes to influence the revenue and returns outlook for the industry.

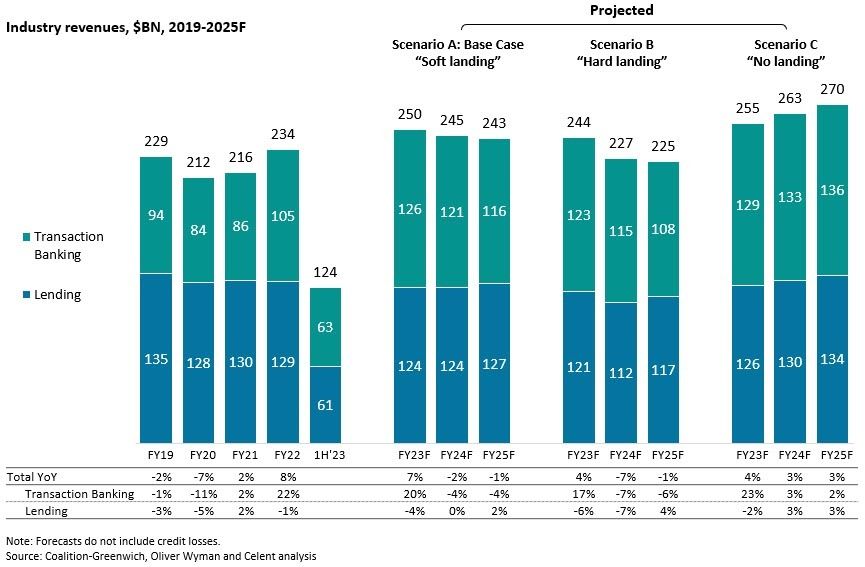

The report details a framework to assess the impact of proposed capital changes and other forces on revenues and returns. It explores three broad economic scenarios to frame the outlook for industry revenues. None of these scenarios accounts for changes to capital rules, which will not be fully phased in until after the forecast period of 2023-2025.

- In the base case, central banks (and policymakers) deliver a Soft Landing - bringing inflation under control without pushing any of the major economies into deep or prolonged recessions. Economic uncertainty and volatility (across asset classes) persist for most of the forecast period, but inflation eventually subsides without any major shocks to asset prices or credit markets. Capital markets reopen and release significant latent demand.

- In the bear case, in an effort to tame inflation, central banks push the global economy and the industry into a Hard Landing that includes recessions in one or more major economies, with significant shocks to asset prices and deteriorating credit conditions. The economic conditions slow inflation, setting the scene for a recovery towards the end of the forecast period.

- In the bull case (No Landing) the major global economies heat back up, despite central bank efforts to slow economic growth and inflation. Steady but modest rate hikes and ongoing uncertainty support Transaction Banking and Securities Services businesses geared to interest rates and Markets businesses geared to volatility, respectively. Financing and IBD activity are constrained by the high rates environment.

For those interested in industry revenue projections across Wholesale Banking, you can access the full report from Oliver Wyman’s website. As Celent’s Corporate Banking team is keenly interested in advancing the fortunes of transaction banking and commercial lending, we’ll dig deeper into the revenue projections for those two segments.

In 2022, Transaction Banking (+22%) delivered its strongest year of growth since the Great Financial Crisis (GFC), capitalizing on the sharp rise in interest rates. Momentum accelerated into 2023, though growth is expected to taper in late 2023 as competition for balances increases and net interest margins (NIM) compress.

Looking at the projected scenarios, under a soft landing, industry revenues are expected to stabilize, with a lasting shift towards players with stronger Transaction Banking franchises, and a low return environment will linger without management action. Under a hard landing, as higher rates erode, widespread industry weakness is expected along with further industry turmoil. Under the no-landing scenario, industry revenues are supported by strong growth, NIM expansion, and high volatility; wholesale revenue pools continue to shift away from investment banking businesses.

Considering how these forecasts translate into technology strategy for banks and solution providers, net interest income (NIM) is expected to remain above pre-pandemic levels, helping to fund grow-the-bank initiatives. However, proposed increased capital rules under Basel 3 could prompt banks to reduce the capital intensity of products, possibly by partnering with non-banks on loan origination, consolidating activities that deliver significant returns at scale, and radically overhauling the technology and operations that support the business to improve operating margins.

The report maintains that sustainable efficiency efforts require banks to a) take a forward-looking of the industry outlook, the revenue potential for the business, and the operating model required to deliver and b) set a vision for sustainable cost management that suits the specific circumstances and cost challenges of the businesses. Depending on a bank’s business model, efficiency priorities may include hyper-automating platforms for services shared across CIB businesses, radically simplifying the global offering and investing in modernization in core end-to-end (client) processes and scaling down the back office through offshoring and partnerships with third parties.

Celent looks forward to helping banks to rationalize their technology spending and prepare for the future. We just published Corporate Banking IT Spending Forecasts by Technology, 2023-2028. The outlook for IT spending in 2024 remains positive. Celent expects global corporate banking IT spending in 2024 to reach $139 billion, an increase of 5.6% in 2023. Although solid growth will continue the following year, 2024 marks a high point for the forecast. We see the overall market will expand at 5.4% to reach $147 billion in 2025, driven by investment in digital products and services, payments transformation, legacy modernization, and a variety of associated cloud migration opportunities.

How can we help you?

[1] Wholesale Banks in this report refers to the Markets (Sales & Trading), Investment Banking (Advisory & Underwriting), Corporate & Transaction Banking, and Securities Services (Custody & Fund Services) businesses of global financial institutions.