Alternative and private market investing have historically been difficult for the wealth management channel to execute and manage. Asset managers are focusing more efforts on distribution into retail wealth management, and financial advisors, family offices and HNW/accredited investors are increasing their adoption and allocations to alternatives. But if the democratization of alternative investments is to reach its full potential, the pain points that financial advisors, operational teams, and end investors currently face today must be solved.

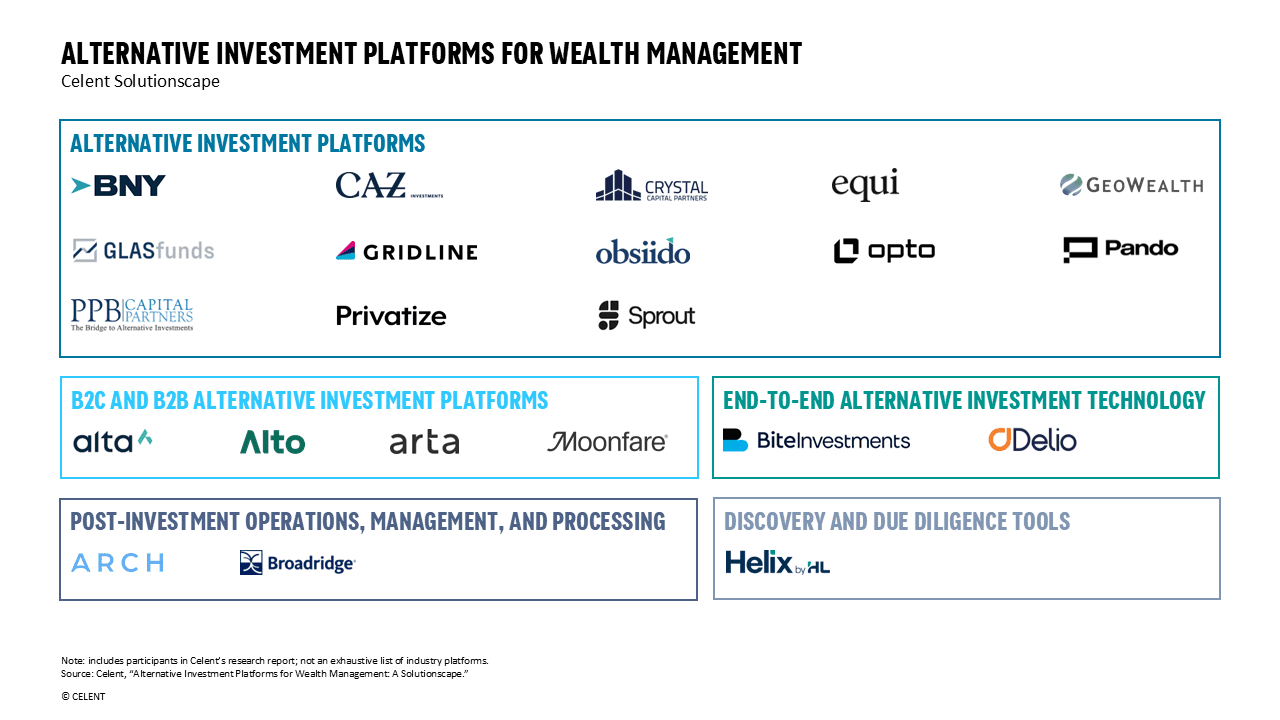

Celent’s recent research report, Alternative Investment Platforms for Wealth Management: A Solutionscape, profiles 22 alternative investment platforms and tech providers based on in-depth interviews with the companies. Through technology, open integrations, and dedicated service, these companies are solving four major problems that wealth management firms, family offices, and individual investors face today:

Lack of access to alternative investment strategies

Suboptimal sourcing experience

Operational complexity and inefficiency

Siloed inveseting, performance, and reporting

The following graphic presents the companies profiled in the research report. Below the graphic, see how they’re solving each of the four problems.

Lack of access to alternative investment strategies

The wealth management channel has historically seen limited access to alternative and private market investment opportunities due to a lack of available options, high investment minimums, a lack of education or understanding, and operational burdens. The platforms profiled in this report are solving the "access problem" through:

curated selections and marketplaces of high-quality funds

funds with lower investment minimums, fund of funds, feeder funds, etc.

educational resources for advisors and end investors

automation that is purpose-built for operational workflows

Suboptimal sourcing experience

CIOs, advisors, family offices, and end investors struggle with discovery and due diligence of alternative investments due to few available options, lack of information on funds, and little customization. Investment platforms are solving the "sourcing problem" with:

streamlined fund search and filtering

detailed information on funds, managers, and performance

customizable funds and strategies

Operational complexity and inefficiency

Operational teams face challenges involved with processing and managing documents across the investment lifecycle that are often fragmented across different sources, emails, PDFs, and paper documents. The data is likely unstructured with varying formatting that takes time and manual effort to aggregate. Platform providers are solving the "operational problem" with:

intelligent automation and AI that ingests, consolidates, and pre-populates fund documents and statements

automation of subscription documents, fund statements, tax forms (K-1s), capital calls, distributions, and more

automation of portfolio insights and performance analytics

Siloed investing, performance, and reporting

Alternative and private market investing are currently siloed from traditional investing, yet investors want to understand their total wealth picture. Advisors and end investors struggle viewing alternative and private market investments alongside traditional portfolios because the performance data and reporting are separated by different systems. Alternative investment platforms are solving the "siloed" problem through:

integrations with downstream portfolio management and reporting systems that advisors already use

hybrid public and private investment strategies, funds, and model portfolios

B2C apps combining public and private investing

To learn which alternative investment platforms are solving these problems and how, access the full report here.