The vendor market in reconciliation has become crowded in which several players with different backgrounds, maturity, value propositions, technology sophistication, target markets, and price points compete.This report analyzes the evolution of reconciliation solutions and profiles 18 reconciliation software solutions including a non-exhaustive yet diverse mix of solutions and providers.They are: Bloomberg, Broadridge, Duco, EZOPS, Finastra, Finbox, FIS, Gresham Technologies, Infosys, Intellect Design Arena, Linedata, Operartis, ReconArt, SmartStream, SS&C Advent, TCS, Torstone, and Xceptor.

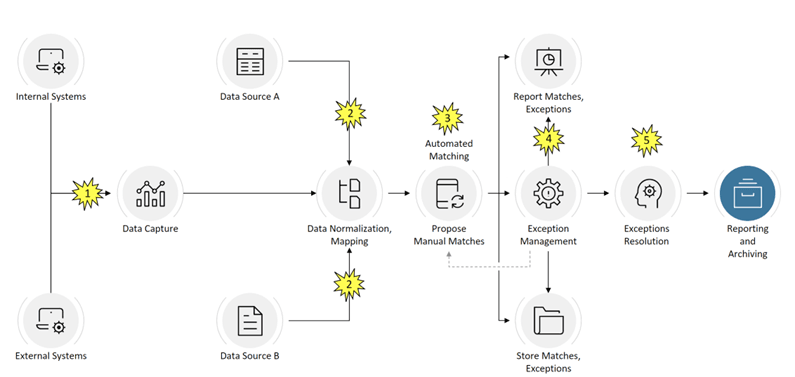

Overview of the Traditional Reconciliation Workflow and Its Pain points