As we near the end of 2024, the macroeconomic and geopolitical landscape remains challenging. These dynamics have the potential to reshape economic and regulatory policies worldwide in the coming year. At the same time, banks are grappling with heightened cyber threats while beginning to embrace the transformative changes brought by Generative AI. From optimizing their technology infrastructure to scaling data and AI solutions that enhance employee efficiency and enable next-generation product capabilities, 2025 promises to be a pivotal (and costly) year for bank product and technology organizations.

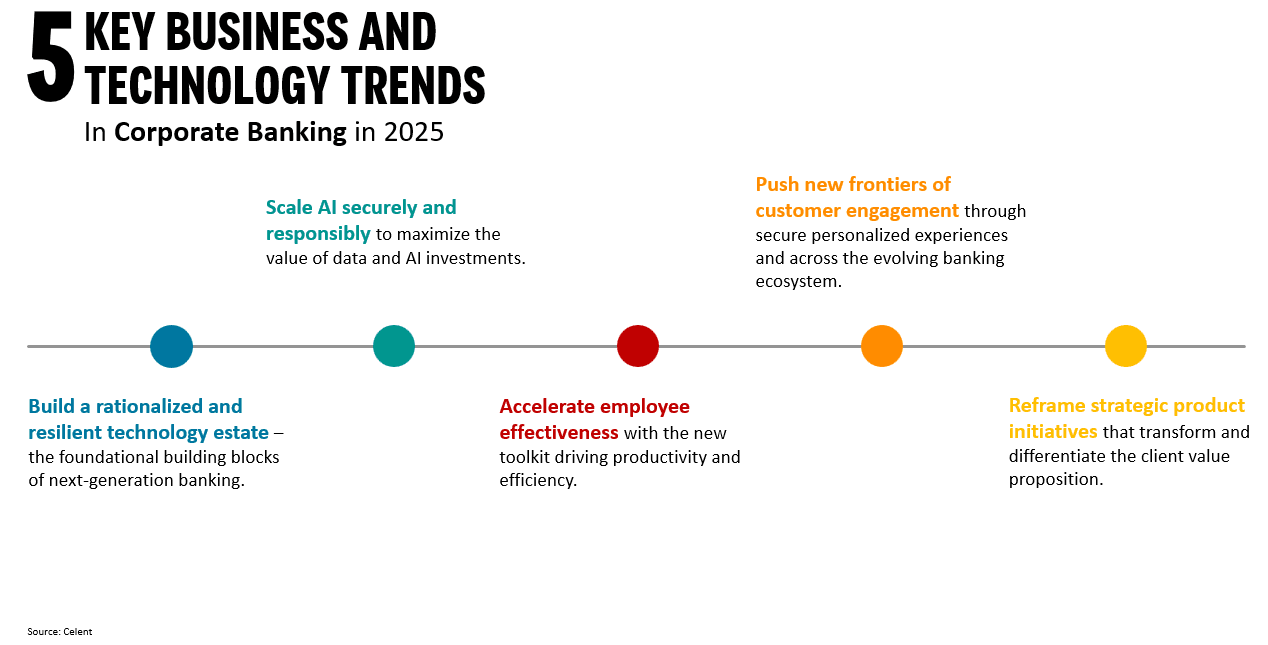

This Celent report highlights five major themes of change in 2025 and details the underlying forces at play, and projects how banks will employ technology to address these challenges and opportunities.