Tokyo Financial Information & Technology Summit (TFITS) is the only event in Japan focused on the opportunities and challenges facing IT, data, and operations executives from financial institutions.

TFITS is a hybrid conference hosted by WatersTechnology and sponsored by six solution providers across APAC, with 25 speakers and 250+ delegates. The 2022 in-person summit was held on June 29 and featured an agenda packed with practical insights on a variety of topics, including:

- Tech Leaders Spotlight: Industry Updates, User Cases, and Business-driven IT Approach

- Data Leaders Spotlight: Trends and Innovation in Quantitative Analysis and How to Drive Business Outcome

- Investor Spotlight: Build Resilience to Your Portfolios with Extensive Automation

- Trading Panel: Operational Alpha in Capital Markets: Achieving Cost Efficiency and Resilience

- Remote Working Spotlight: Implication on Operating Models and Risk

- Cloud Panel: Migration to Cloud―What Is There to Keep from Your Legacy System

I had the privilege of moderating a main stage strategic panel discussion titled “Migration to Cloud: What Is There to Keep from Your Legacy System.”

OUR ESTEEMED PANELISTS:

- Masayuki Ichioka | Vice President, Goldman Sachs Japan Co., Ltd. || Goldman Sachs Bank USA Tokyo Branch

- Yasushi Ichikawa | Deputy General Manager, Global Markets Technology, SMBC Nikko Securities

- Michitoshi Kimura | Chief Manager, Business Development Investor Services Planning Division, The Master Trust Bank of Japan

The Cloud Panel at this year's TFITS in-person conference featured three cloud technology leaders from Tokyo's capital markets. They discussed their experiences in implementing cloud technology from planning to build to operations, as well as their efforts to accelerate various front/middle/back office initiatives in the cloud—and its potential and challenges.

Panel topics included the following:

- Japan’s state of migrating to cloud: regulations, cost, and legacy IT considerations

- The value case of the hybrid cloud approach

- How migrating to the cloud will impact your data delivery strategies

At the beginning of the panel, Celent gave a short keynote on the latest trends in cloud computing.

MODERATOR KEYNOTE: "Latest Cloud Trends in the Global Financial Industry”

1. Expectations for beyond-the-cloud technology

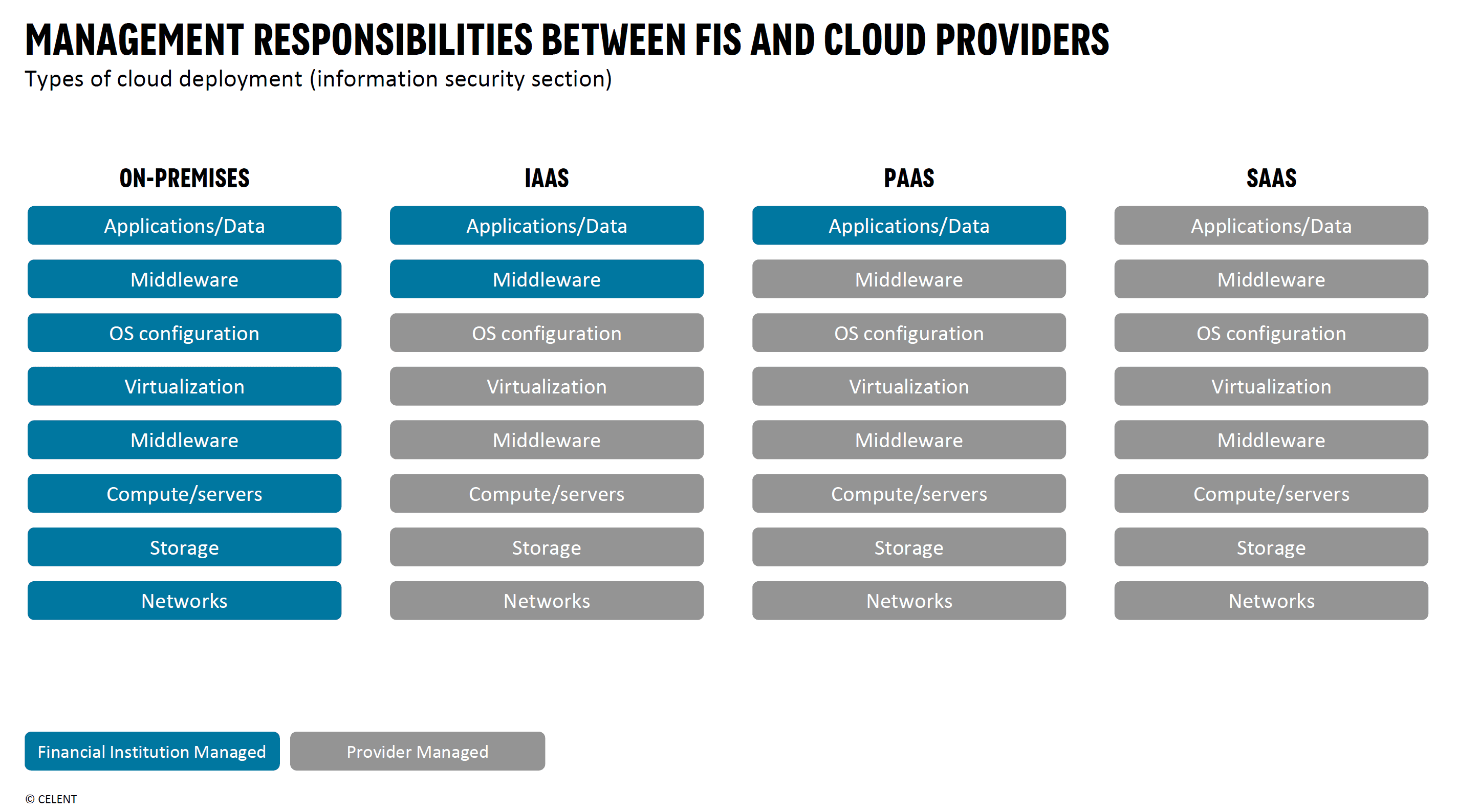

- Three "as-a-Service" models of cloud computing

- Cloud technology adoption practices in financial institutions—a hybrid approach

- Seven key considerations for moving to the cloud

- Sharing of management responsibilities between the financial institution and the cloud provider

2. Cloud urban myths

- Is public cloud less expensive than on-premise?

- Is the cloud less secure than on-premise?

- Should we follow suit after someone else experiences "fail first"?

- Should we hold off until we identify a strong cloud provider?

- Are cloud use cases limited to big data?

- Is it too costly to train and upskill employees for cloud?

- Are open source tools essential for leveraging the cloud?

The era of cloud computing has taken a big step forward. The adoption of cloud computing in financial institutions is truly accelerating. Financial institutions are evaluating how to address compliance, ecosystem, risk, and security issues—and determining where and how to deploy cloud computing to meet their business needs.

Financial institutions are no longer asking, "Should we go to the cloud?” They ask, "How do we go cloud?” But a simple issue still lingers. Celent calls it the "cloud urban legend.” Now that cloud providers are verticalizing their products and services, it is important for financial institutions to know the truth about what is happening there.

This keynote discussed the essentials of best practices from Celent's cloud research sources and some of the cloud's urban legends.