Most onboarding solutions, whether built by a bank or solution provider, focus on a broad set of processes across sales automation, know-your-customer (KYC)/know-your-business (KYB), credit analysis, account opening, service/product fulfillment, and ongoing maintenance. But these same solutions often miss a critical step, especially for the most complex transaction banking services—technical onboarding for integration and connectivity.

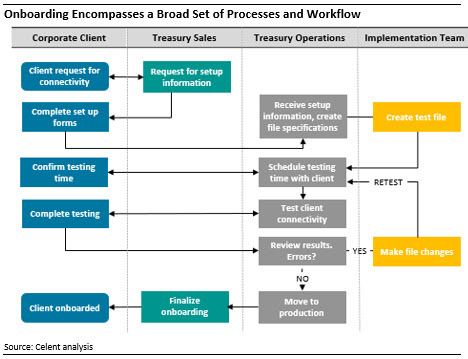

The technical onboarding process involves multiple handoffs between clients, treasury sales, treasury operations, and implementation teams. Although the steps may not individually be time-consuming, there are often delays in scheduling test times or remediating mapping files, extending the duration and time to revenue before the client is onboarded. We developed a simplified view of the technology process below:

Unfortunately, many corporate clients encounter unresolved implementation and integration challenges during technical onboarding, especially for corporates moving to a new banking provider. With best-in-class digital experiences a critical driver of bank relationships, the time is now to evaluate the effectiveness of your technical onboarding process and tools.